Rosetta Stone 2012 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2012 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

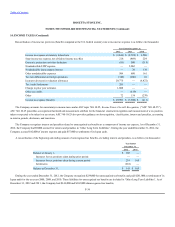

respectively, which if recognized, would affect income tax expense. The Company does not expect that the amounts of unrecognized tax benefits will

change significantly within the next twelve months.

The Company is subject to taxation in the U.S. and various states and foreign jurisdictions. The Company's tax years 2008, 2009, 2010, and 2011

are subject to examination by the tax authorities. As of December 31, 2012, the Company has no ongoing income tax examinations. During 2012, the

Company closed its U.S. exam related to tax year 2008 and its Japan audit related to the tax years 2008, 2009, and 2010. The audits resulted in no

material audit assessments.

No provision was made in 2012 for U.S. income taxes on undistributed earnings of the foreign subsidiaries as it is the Company's intention to

utilize those earnings in the foreign operations for an indefinite period of time or to repatriate such earnings only when it is tax effective to do so.

The Company made income tax payments of $4.0 million, $1.7 million, and $10.0 million in 2012, 2011 and 2010, respectively.

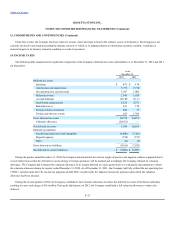

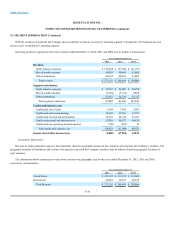

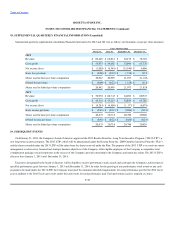

During 2012, the Company had a change in our chief operating decision maker (CODM), which led to a change in the fourth quarter to what our

CODM uses to measure profitability and allocate resources. Accordingly, beginning with the fourth quarter of 2012, the Company is managed in three

operating segments—North America Consumer, ROW Consumer and Institutional. These segments also represent the Company's reportable segments.

Concurrent with the change in reportable segments, the Company reviewed the expenses included in segment contribution. The Company identified

additional expenses including certain customer care, coaching, finance and sales and marketing costs that directly benefit individual reportable segments

and are included in segment contribution. Prior period data has been restated to be consistent with the current year presentation.

Segment contribution includes segment revenue and expenses incurred directly by the segment, including material costs, service costs, customer

care and coaching costs, and sales and marketing expense. The Company does not allocate expenses beneficial to all segments, which include certain

general and administrative expenses, facilities and communication expenses, purchasing expenses and manufacturing support and logistic expenses.

These expenses are included in the unallocated expenses section of the table presented below. Revenue from transactions between the Company's

operating segments is not material.

F-35