Rosetta Stone 2012 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2012 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

guidance is not anticipated to have a material impact on the Company's reported results of operations or financial position.

In February 2013, the FASB issued ASU No. 2013-02, "

" or "ASU 2013-02" which requires disclosure of significant amounts reclassified out of accumulated other

comprehensive income by component and their corresponding effect on the respective line items of net income. This guidance is effective for reporting

periods beginning after December 15, 2012 and is not expected to have a material impact on the Company's consolidated financial statements or

financial statement disclosures.

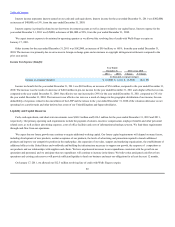

The functional currency of our foreign subsidiaries is their local currency. Accordingly, our results of operations and cash flows are subject to

fluctuations due to changes in foreign currency exchange rates. The volatility of the prices and applicable rates are dependent on many factors that we

cannot forecast with reliable accuracy. In the event our foreign sales and expenses increase, our operating results may be more greatly affected by

fluctuations in the exchange rates of the currencies with which we do business. At this time we do not, but we may in the future, invest in derivatives or

other financial instruments in an attempt to hedge our foreign currency exchange risk.

Interest income and expense are sensitive to changes in the general level of U.S. interest rates. However, based on the nature and current level of

our marketable securities, which are primarily short-term investment grade and government securities and our notes payable, we believe that there is no

material risk of exposure.

Our consolidated financial statements, together with the related notes and the report of independent registered public accounting firm, are set forth

on the pages indicated in Item 15.

None.

Our management, with the participation of our Chief Executive Officer and our Chief Financial Officer, evaluated the effectiveness of our

disclosure controls and procedures as of December 31, 2012. The term "disclosure controls and procedures," as defined in Rules 13a-15(e) and 15d-

15(e) under the Securities Exchange Act of 1934, as amended (the "Exchange Act"), means controls and other procedures of a company that are

designed to ensure that information required to be disclosed by a company in the reports that it files or submits under the Exchange Act is recorded,

processed, summarized and reported, within the time periods specified in the SEC's rules and forms. Disclosure controls and procedures include,

without limitation, controls and procedures designed to ensure that information required to be disclosed by a company in the reports that it files or

submits under the Exchange Act is accumulated and communicated to the Company's management, including its principal

66