Rosetta Stone 2012 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2012 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

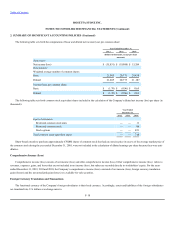

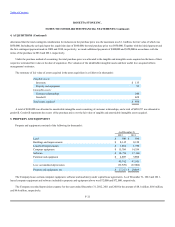

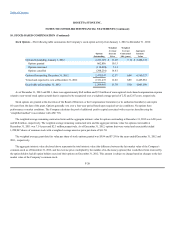

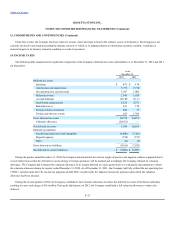

The following table summarizes other current liabilities (in thousands):

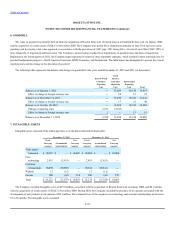

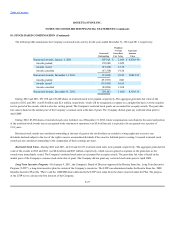

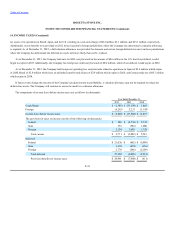

On January 16, 2009, the Company entered into a credit agreement with Wells Fargo Bank, N.A. ("Wells Fargo"), which provided the Company

with a $12.5 million revolving line of credit. This revolving credit facility had a two-year term and the applicable interest rate was 2.5% above one

month LIBOR.

Interest expense for the year ended December 31, 2012 and 2011 was zero and $5,000, respectively.

On January 17, 2011, the Company allowed its $12.5 million revolving line of credit with Wells Fargo to expire and we had no borrowings

outstanding for any of the periods presented.

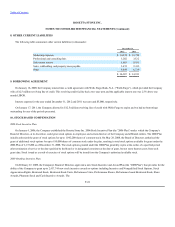

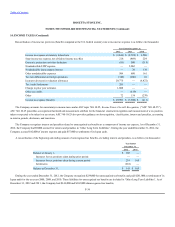

On January 4, 2006, the Company established the Rosetta Stone Inc. 2006 Stock Incentive Plan (the "2006 Plan") under which the Company's

Board of Directors, at its discretion, could grant stock options to employees and certain directors of the Company and affiliated entities. The 2006 Plan

initially authorized the grant of stock options for up to 1,942,200 shares of common stock. On May 28, 2008, the Board of Directors authorized the

grant of additional stock options for up to 195,000 shares of common stock under the plan, resulting in total stock options available for grant under the

2006 Plan of 2,137,200 as of December 31, 2008. The stock options granted under the 2006 Plan generally expire at the earlier of a specified period

after termination of service or the date specified by the Board or its designated committee at the date of grant, but not more than ten years from such

grant date. Stock issued as a result of exercises of stock options will be issued from the Company's authorized available stock.

On February 27, 2009, the Company's Board of Directors approved a new Stock Incentive and Award Plan (the "2009 Plan") that provides for the

ability of the Company to grant up to 2,437,744 new stock incentive awards or options including Incentive and Nonqualified Stock Options, Stock

Appreciation Rights, Restricted Stock, Restricted Stock Units, Performance Units, Performance Shares, Performance based Restricted Stock, Share

Awards, Phantom Stock and Cash Incentive Awards. The

F-24

Marketing expenses $ 16,922 $ 12,726

Professional and consulting fees 3,282 3,322

Sales return reserve 5,883 9,931

Sales, withholding, and property taxes payable 3,451 2,413

Other 6,849 6,519

$ 36,387 $ 34,911