Rosetta Stone 2012 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2012 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

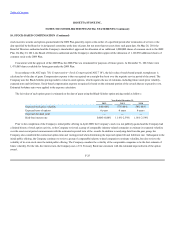

motivate senior management to achieve key financial and strategic business objectives of the Company; offer eligible executives a competitive total

compensation package; reward executives in the success of the Company; provide ownership in the Company; and retain key talent. Executives

designated by the Board of Directors were eligible to receive a minimum number of shares of restricted common stock for each milestone level of total

market capitalization achieved, as specified in individual award agreements. The shares received would be restricted in that after issuance of the shares,

they would be subject to vesting over a two-year period. For each milestone level of market capitalization reached above the base market capitalization as

of October 1, 2010, the compensation committee of the Board of Directors would allocate the pre-defined share incentive pool for that milestone reached

amongst the participating executives with the minimum number of shares specified in individual award agreements. Although minimum participation

percentages were communicated to certain plan participants, all share grants under the LTIP were contingent upon achievement of the market

capitalization thresholds.

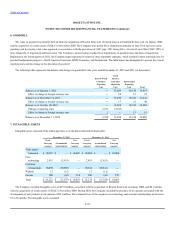

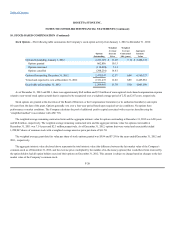

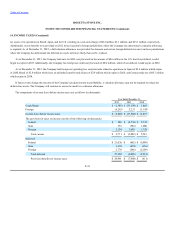

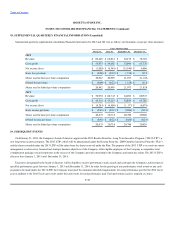

In accordance with the agreements communicated to the executives after the approval of the plan by the Board of Directors, the LTIP participants

were granted minimum participation percentages of each tranche of shares issued at each milestone level reached. Throughout the year ended

December 31, 2011, the target market capitalization required to trigger the first issuance of shares was below the minimum threshold, and no shares

were issued. The minimum participation percentages given to plan participants were considered grants in accordance with the provisions of ASC 718.

The grant date fair value of the minimum awards was $6.1 million, which was derived using a Monte Carlo valuation model. This value would have

been amortized as stock-based compensation expense over the derived service period of five years.

On November 30, 2011, as a result of the substantial reduction in incentive and retentive value of the plan, the board of directors cancelled the

LTIP. As a result of the cancellation, the company recognized $4.9 million in stock-based compensation expense equal to the total unamortized value of

the awards. There were no shares issued from the LTIP to any executive prior to its cancellation.

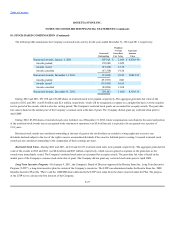

Stock-based compensation expense related to the LTIP was $6.0 million for the year ended December 31, 2011. As of December 31, 2011, there

was no unrecognized stock-based compensation expense related to awards under the LTIP.

F-28