Rosetta Stone 2012 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2012 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

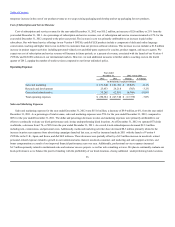

to a decrease in gross profit of $0.6 million, from $219.9 million to $219.3 million, and an increase in operating expenses of $40.8 million. The decrease

in gross profit was primarily due to higher direct costs associated with our web-based services offering Version 4 that include higher direct

costs to deliver to customers than our previous software solutions. The increase in operating expenses was primarily due to $16.2 million in personnel-

related costs, $20.2 million in increased media and marketing activities, primarily outside of the U.S., $1.8 million increase in professional services and

$2.0 million increase in depreciation and amortization expenses incurred to support the business expansion outside of the U.S., and $0.6 million

increase in lease abandonment due to the reversal of the lease abandonment expenses in the third quarter of 2010.

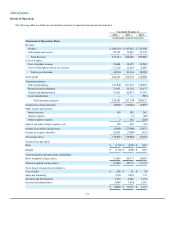

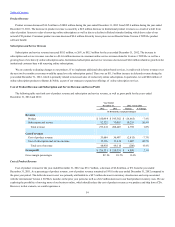

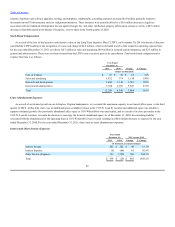

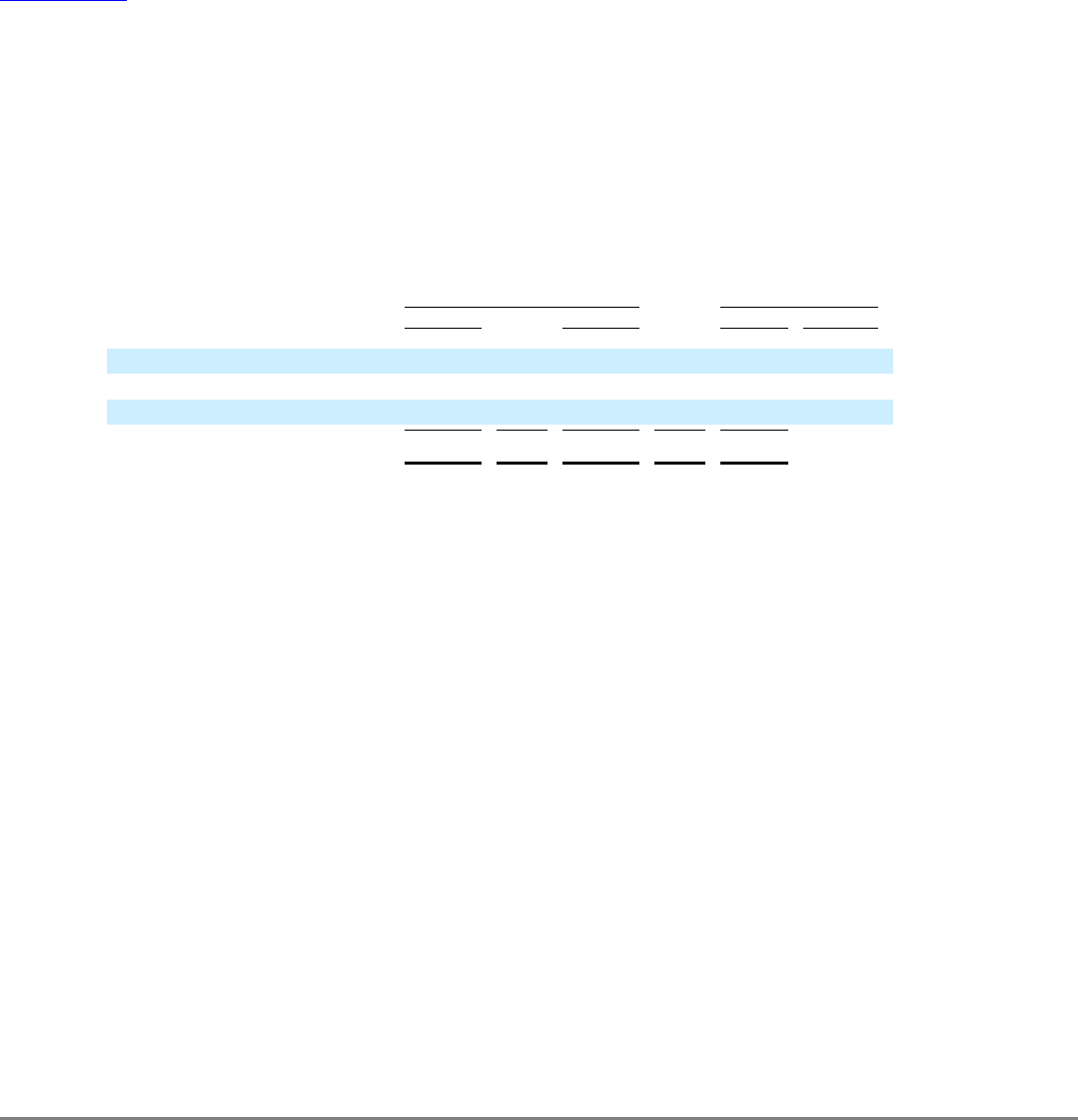

The following table sets forth revenue for each of our three operating segments for the years ended December 31, 2011 and 2010:

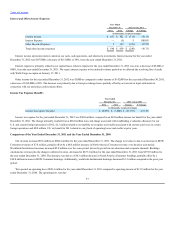

North America Consumer revenue decreased $4.0 million or 3% from the year ended December 31, 2010 to the year ended December 31, 2011,

the result of decreases of $9.5 million and $5.4 million from our retail and kiosk sales channels, respectively, partially offset by an increase of

$10.9 million from our direct-to-consumer sales channel. In 2011 we experienced a shift in North America consumer revenue from retail to our direct-

to-consumer sales channel. The number of kiosks within North America decreased from 173 at December 31, 2010 to 103 at December 31, 2011,

driving the decrease in revenue from this channel. North America Consumer bookings, calculated as North America Consumer revenue plus the change

in North America Consumer deferred revenue decreased $16.3 million to $157.4 million for the year ended December 31, 2011 from $173.8 million for

the year ended December 31, 2010, driven by lower prices across the North America Consumer channels.

ROW Consumer revenue increased $7.8 million or 18% from the year ended December 31, 2010 to the year ended December 31, 2011. ROW

Consumer revenue increased $3.3 million, $3.1 million and $1.9 million in Korea, Germany and the UK, respectively. During 2011 we experienced an

increase in revenue across all consumer channels in Korea and Germany in addition to increases in all channels except retail in the UK. ROW Consumer

bookings, calculated as ROW Consumer revenue plus the change in ROW deferred revenue increased $10.8 million, from $43.2 million for the year

ended December 31, 2010 to $54.0 million for the year ended December 31, 2011. The increase in revenue and bookings was driven by expanded

international sales and marketing efforts.

Institutional revenue increased $5.8 million or 11% from the year ended December 31, 2010 to the year ended December 31, 2011. The increase in

Institutional revenue was primarily due to the expansion of our direct sales force and a shift from sales of perpetual licenses to sales of renewing online

subscriptions. As a result, we had a $5.8 million increase in education revenue and a $2.7 million increase in corporate and non-profit revenue in 2011,

compared to the prior year period. These increases were partially offset by a $2.7 million decrease in governmental revenues, primarily as a result of

government budget cuts including the non-renewal of the U.S. Army and U.S. Marines Corps contracts. Institutional bookings, calculated as

Institutional revenue plus the change in Institutional deferred revenue, decreased to $61.8 million for the year ended December 31, 2011 from

$62.9 million for the year ended December 31, 2010. The decrease in bookings was due to an $8.6 million decrease in government bookings primarily

as a result of the non-renewal of the U.S. Army and the U.S.

58

North America Consumer $ 157,561 58.7%$ 161,575 62.4%$ (4,014) -2.5%

Rest of World Consumer 50,465 18.8% 42,688 16.5% 7,776 18.2%

Institutional 60,423 22.5% 54,605 21.1% 5,818 10.7%

Total Revenue $ 268,449 100.0%$ 258,868 100.0%$ 9,581 3.7%