Rosetta Stone 2012 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2012 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

may not be able to negotiate or renegotiate licenses on commercially reasonable terms, or at all, and the third-party software may not be appropriately

supported, maintained or enhanced by the licensors. If we are unable to obtain the rights necessary to use or continue to use third-party technology or

content in our products and services, the inability to support, maintain and enhance any software could result in increased costs, or in delays or

reductions in product shipments until equivalent software could be developed, identified, licensed and integrated.

We incorporate open source software into our products and may use more open source software in the future. The use of open source software is

governed by license agreements. The terms of many open source licenses have not been interpreted by U.S. courts, and there is a risk that these licenses

could be construed in a manner that could impose unanticipated conditions or restrictions on our ability to commercialize our products. In such event,

we could be required to seek licenses from third parties in order to continue offering our products, make generally available, in source code form,

proprietary code that links to certain open source modules, re-engineer our products, discontinue the sale of our products if re-engineering could not be

accomplished on a cost-effective and timely basis, or become subject to other consequences. In addition, open source licenses generally do not provide

warranties or other contractual protections regarding infringement claims or the quality of the code. Thus, we may have little or no recourse if we

become subject to infringement claims relating to the open source software or if the open source software is defective in any manner.

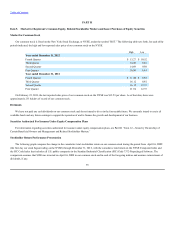

As of December 31, 2012, funds affiliated with ABS Capital Partners beneficially owned in the aggregate shares representing approximately 23%

of our outstanding voting power. Two managing members of the general partner of ABS Capital Partners currently serve on our board of directors.

Additionally, as of December 31, 2012, Norwest Equity Partners VIII, LP, or Norwest, beneficially owned in the aggregate shares representing

approximately 15% of our outstanding voting power. One managing member of the general partner of Norwest currently serves on our board of

directors. As a result, these stockholders could together potentially have significant influence over all matters presented to our stockholders for approval,

including election and removal of our directors and change of control transactions. The interests of these stockholders may not always coincide with the

interests of the other holders of our common stock.

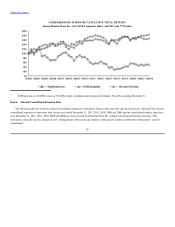

The trading market for our common stock depends in part on the research and reports that industry or financial analysts publish about us or our

business. If one or more of the analysts covering our business downgrade their evaluations of or recommendations regarding our stock, or if one or

more of the analysts cease providing research coverage on our stock, the price of our stock could decline. If one or more of these analysts cease

providing research coverage on our stock, we could lose visibility in the market for our stock, which in turn could cause our stock price to decline.

The market price for our common stock has experienced significant fluctuations and may continue to fluctuate significantly. Our quarterly financial

results have fluctuated in the past and are likely to vary significantly in the future due to a number of factors, many of which are outside of our control

31