Rosetta Stone 2012 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2012 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

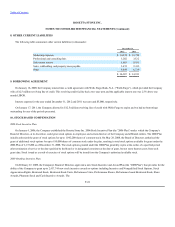

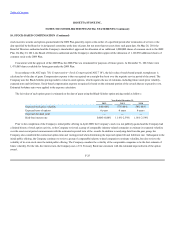

adopted this guidance beginning in fiscal year 2012, and the adoption of such guidance did not have a material impact on the Company's reported results

of operations or financial position.

In July 2012, the FASB issued new guidance on the impairment testing of indefinite-lived intangible assets (ASU 2012-02,

), effective for calendar years beginning after September 15, 2012.

Early adoption is permitted. The objective of this standard is to simplify how an entity tests indefinite-lived intangible assets for impairment. The

amendments in this standard will allow an entity to first assess qualitative factors to determine whether it is more likely than not that an indefinite-lived

intangible asset is impaired as a basis for determining whether it is necessary to perform the quantitative impairment test. Only if an entity determines,

based on qualitative assessment, that it is more likely than not that the indefinite-lived intangible asset is impaired will it be required to determine the fair

value of the indefinite-lived intangible asset and perform the quantitative impairment test. The Company intends to adopt this guidance beginning in

fiscal year 2013, and the adoption of such guidance is not anticipated to have a material impact on the Company's reported results of operations or

financial position.

In February 2013, the FASB issued ASU No. 2013-02, "

," or "ASU 2013-02" which requires disclosure of significant amounts reclassified out of accumulated other

comprehensive income by component and their corresponding effect on the respective line items of net income. This guidance is effective for reporting

periods beginning after December 15, 2012 and is not expected to have a material impact on the Company's consolidated financial statements or

financial statement disclosures.

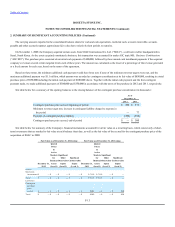

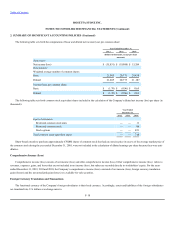

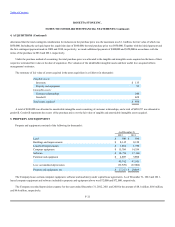

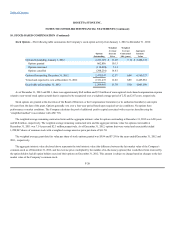

Inventory consisted of the following (in thousands):

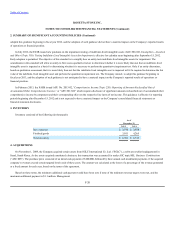

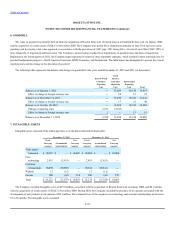

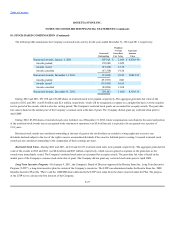

On November 1, 2009, the Company acquired certain assets from SGLC International Co. Ltd. ("SGLC"), a software reseller headquartered in

Seoul, South Korea. As the assets acquired constituted a business, this transaction was accounted for under ASC topic 805,

("ASC 805"). The purchase price consisted of an initial cash payment of $100,000, followed by three annual cash installment payments, if the acquired

company's revenues exceed certain targeted levels each of these years. The amount was calculated as the lesser of a percentage of the revenue generated

or a fixed amount for each year, based on the terms of the agreement.

Based on these terms, the minimum additional cash payment would have been zero if none of the minimum revenue targets were met, and the

maximum additional payment is $1.1 million. Management

F-20

Raw materials $ 3,570 $ 2,458

Finished goods 3,011 4,265

Total inventory $ 6,581 $ 6,723