Rosetta Stone 2012 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2012 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

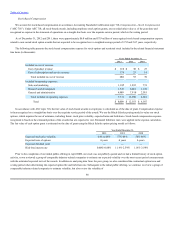

Table of Contents

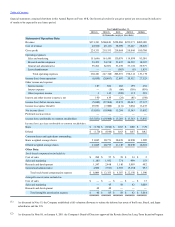

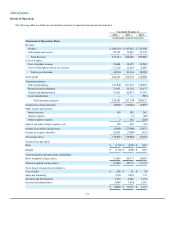

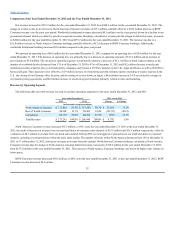

campaigns in the United States. As part of business assessment in 2012, we are evaluating the profitability and potential of each existing and new

market. As a result of this process, we consolidated our European presence to the London office and closed the German office in June 2012. We expect

sales and marketing expenses to continue to increase in future periods as we seek to stabilize and expand our operations in existing and new markets.

Research and development expenses consist primarily of personnel costs and contract development fees associated

with the development of our solutions. Our development efforts are primarily based in the United States and are devoted to modifying and expanding

our product portfolio through the addition of new content and new complementary products and services to our language learning solutions. We expect

our investment in research and development expenses to increase in future years as we restructure operations to optimize research and development

initiatives and deliver new products that will provide us with significant benefits in the future.

General and administrative expenses consist primarily of personnel costs of our executive, finance, legal, human

resources and other administrative personnel, as well as accounting and legal professional services fees and other corporate expenses. In 2012, there

have been and we expect that there will continue to be increases to certain general and administrative expenses to support our expansion into

international markets. However, we are also taking steps to reduce certain general and administrative expenses as we realign our cost structure to help

fund investment in areas of growth.

Interest and other income (expense) primarily consist of interest income, interest expense, foreign exchange gains and losses, and income from

litigation settlements. Interest expense is primarily related to interest on our capital leases. Interest income represents interest received on our cash, cash

equivalents, and short-term investments. Fluctuations in foreign currency exchange rates in our foreign subsidiaries cause foreign exchange gains and

losses. Legal settlements are related to agreed upon settlement payments from various anti-piracy enforcement efforts.

Income tax expense (benefit) consists of federal, state and foreign income taxes. For the year ended December 31, 2012, our worldwide effective

tax rate was approximately 514%. The income tax expense in 2012 was primarily due to an increase in the valuation allowance of $29.9 million relating

to operations in the U.S. and certain foreign jurisdictions.

We regularly evaluate the recoverability of our deferred tax assets and establish a valuation allowance, if necessary, to reduce the deferred tax

assets to an amount that is more likely than not to be realized (a likelihood of more than 50 percent). Significant judgment is required to determine

whether a valuation allowance is necessary and the amount of such valuation allowance, if appropriate.

When assessing the realization of our deferred tax assets, we consider all available evidence, including:

•the nature, frequency, and severity of cumulative financial reporting losses in recent years;

•the carryforward periods for the net operating loss, capital loss, and foreign tax credit carryforwards;

•predictability of future operating profitability of the character necessary to realize the asset;

42