Rosetta Stone 2012 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2012 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

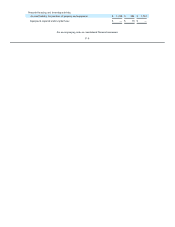

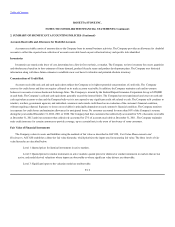

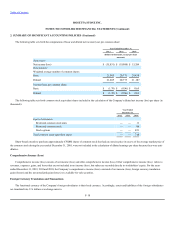

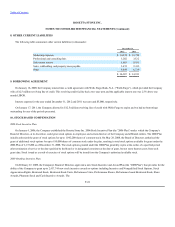

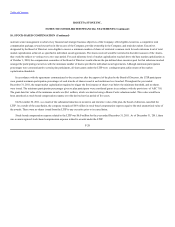

The following table sets forth the computation of basic and diluted net income (loss) per common share:

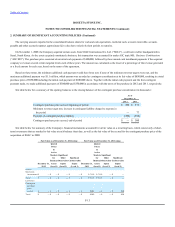

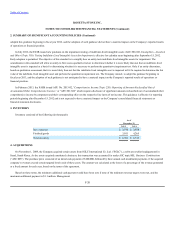

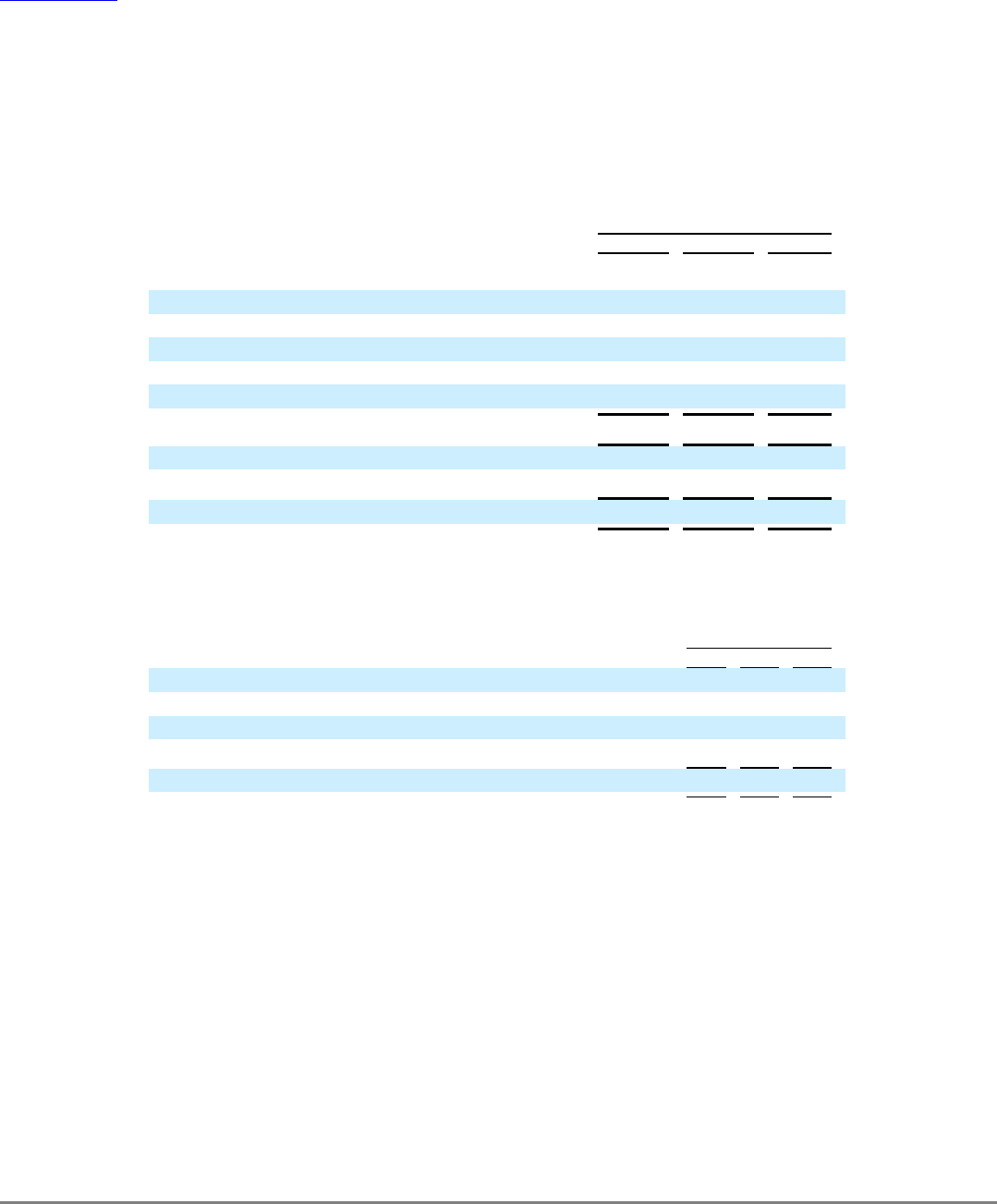

The following table sets forth common stock equivalent shares included in the calculation of the Company's diluted net income (loss) per share (in

thousands):

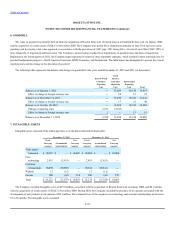

Share-based awards to purchase approximately 470,000 shares of common stock that had an exercise price in excess of the average market price of

the common stock during the year ended December 31, 2010, were not included in the calculation of diluted earnings per share because they were anti-

dilutive.

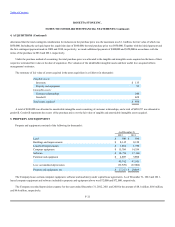

Comprehensive income (loss) consists of net income (loss) and other comprehensive income (loss). Other comprehensive income (loss) refers to

revenues, expenses, gains, and losses that are not included in net income (loss), but rather are recorded directly in stockholders' equity. For the years

ended December 31, 2012, 2011 and 2010, the Company's comprehensive income (loss) consisted of net income (loss), foreign currency translation

gains (losses) and the net unrealized gains (losses) on available-for-sale securities.

The functional currency of the Company's foreign subsidiaries is their local currency. Accordingly, assets and liabilities of the foreign subsidiaries

are translated into U.S. dollars at exchange rates in

F-18

Net income (loss) $ (35,831) $ (19,988) $ 13,284

Weighted average number of common shares:

Basic 21,045 20,773 20,439

Diluted 21,045 20,773 21,187

Income (loss) per common share:

Basic $ (1.70) $ (0.96) $ 0.65

Diluted $ (1.70) $ (0.96) $ 0.63

Restricted common stock units — — 11

Restricted common stock — — 86

Stock options — — 651

Total common stock equivalent shares — — 748