Rosetta Stone 2012 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2012 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

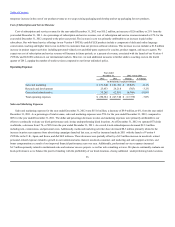

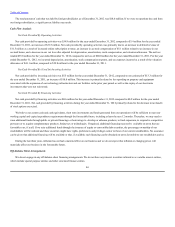

related to hardware and software upgrades, hosting, and telephone. Additionally, consulting expenses increased $4.0 million primarily related to

investment in our IT infrastructure and cost realignment initiatives. These increases were partially offset by a $5.8 million decrease in legal fees

associated with our trademark infringement lawsuit against Google, Inc. and other intellectual property enforcement actions as well as a $0.5 million

decrease in bad debt related to the Border's Group Inc. reserve taken in the fourth quarter of 2010.

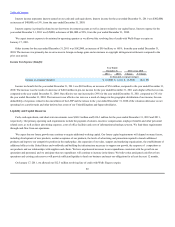

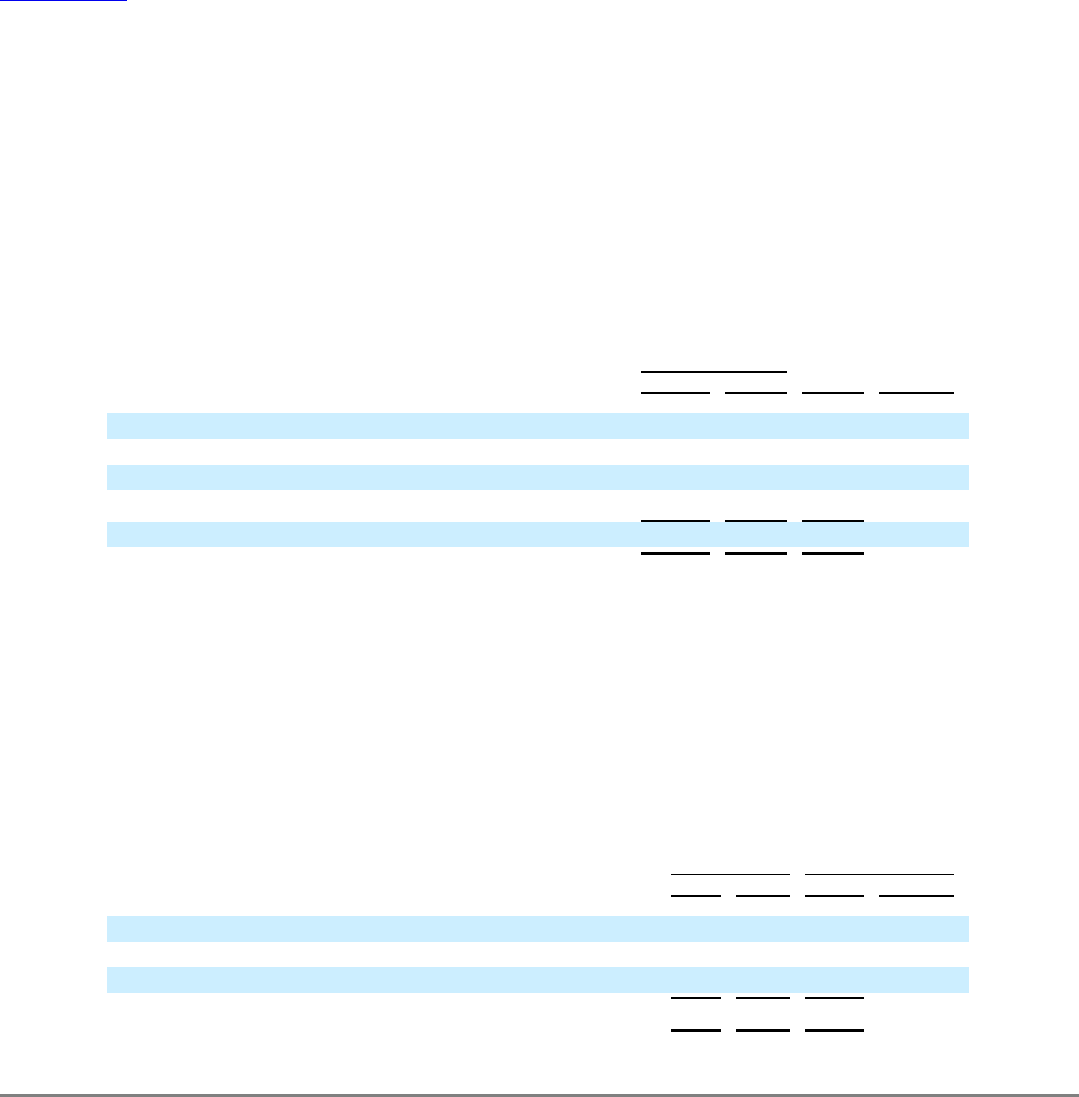

As a result of the loss of the incentive and retentive value of the Long Term Incentive Plan ("LTIP"), on November 30, 2011 the board of directors

cancelled the LTIP resulting in the recognition of a non-cash charge of $4.9 million, which is included in each of the respective operating expense lines

for the year ended December 31, 2011 as follows, $0.7 million in sales and marketing, $0.9 million in research and development, and $3.3 million in

general and administrative. There were no shares issued from the LTIP to any executive prior to its cancellation. Total stock-based compensation by

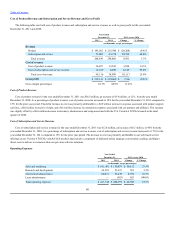

expense line item is as follows:

As a result of accelerated growth in our Arlington, Virginia headquarters, we exceeded the maximum capacity in our leased office space in the third

quarter of 2010. At that time, there was no additional space available for lease in the 1919 N. Lynn St. location and additional space was needed to

support continued growth. Our previously abandoned office space at 1101 Wilson Blvd was unoccupied, and as a result of its close proximity to the

1919 N. Lynn St. location, we made the decision to reoccupy the formerly abandoned space. As of December 31, 2010, the remaining liability

associated with the abandonment of the operating lease at 1101 Wilson Blvd was reversed resulting in a $0.6 million decrease in expense for the year

ended December 31, 2010. For the year ended December 31, 2011, there were no lease abandonment expenses.

62

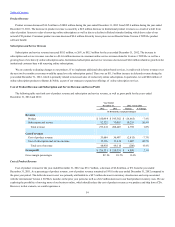

Cost of revenue $ 55 $ 39 $ 16 41%

Sales and marketing 1,932 774 1,158 150%

Research and development 2,448 1,181 1,267 107%

General and administrative 7,918 2,393 5,525 231%

Total 12,298 4,348 7,966 183%

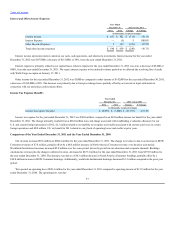

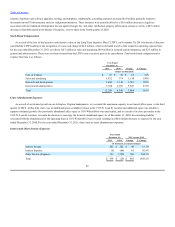

Interest Income 302 $ 262 $ 40 15.3%

Interest Expense (5) (66) 61 92.4%

Other Income (Expense) 142 (220) 362 164.5%

Total $ 439 $ (24) $ 463 1929.2%