Rosetta Stone 2012 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2012 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

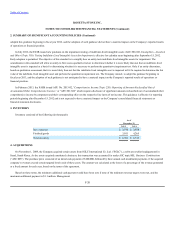

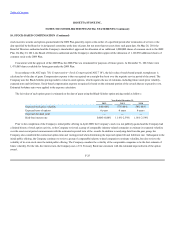

with the trade name and trademark has an indefinite useful life. The estimated life of the website rights is 60 months, and estimated useful life of the

patents are based on the effective date of the purchase agreement through the expiration date of the patents. The Company computes amortization of

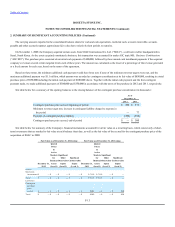

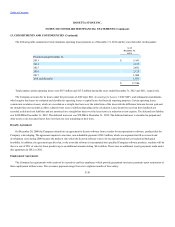

intangible assets on a straight-line basis over the estimated useful life. Below are the estimated useful lives of the intangible assets acquired:

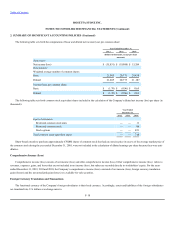

In accordance with ASC topic 360, , the Company reviews its long-lived assets, including property and equipment

and definite-lived intangible assets, for impairment whenever events or changes in circumstances indicate that the carrying amounts of the assets may

not be fully recoverable. If the total of the expected undiscounted future net cash flows is less than the carrying amount of the asset, a loss is recognized

for the difference between the fair value and carrying amount of the asset. There were no impairment charges for the year ended December 31, 2012 and

2011.

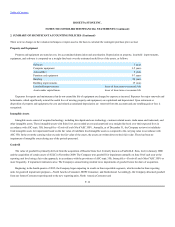

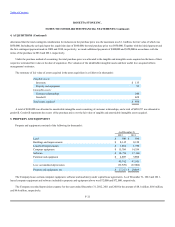

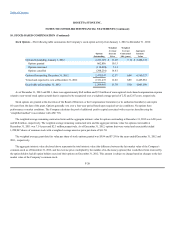

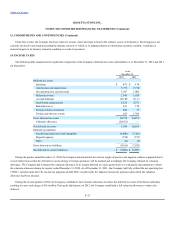

Amortization expense consisted of the following (in thousands):

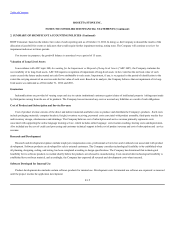

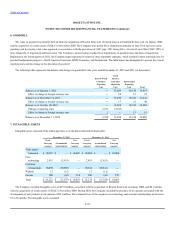

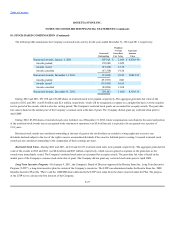

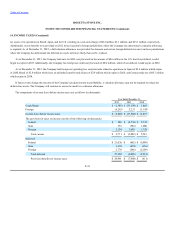

The following table summarizes the estimated future amortization expense related to intangible assets as of December 31, 2012 (in thousands):

F-23

Trade name / trademark Indefinite

Core technology 24 months

Customer relationships 24 months

Website 60 months

Patents 72-100 months

Included in cost of revenue:

Cost of product revenue $ — $ — $ —

Cost of subscription and service revenue — — —

Total included in cost of revenue — — —

Included in operating expenses: $ 40 $ 85 $ 58

Total $ 40 $ 85 $ 58

2013 $ 40

2014 40

2015 40

2016 40

2017 40

Thereafter 18

Total $ 218