Rosetta Stone 2012 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2012 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

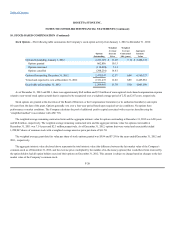

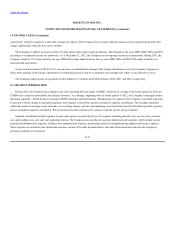

tax assets of its operations in Brazil, Japan, and the U.S. resulting in a non-cash charge of $0.4 million, $2.1 million, and $23.1 million, respectively.

Additionally, no tax benefits were provided on 2012 losses incurred in foreign jurisdictions where the Company has determined a valuation allowance

is required. As of December 31, 2012, a full valuation allowance was provided for domestic and certain foreign deferred tax assets in those jurisdictions

where the Company has determined the deferred tax assets will more likely than not be realized.

As of December 31, 2012, the Company had state tax NOL carryforwards in the amount of $0.6 million in the U.S. that if not utilized, would

begin to expire in 2017. Additionally, the Company has foreign tax credit carryforwards of $0.4 million, which if not utilized, would expire in 2022.

As of December 31, 2012, the Company had foreign net operating loss carryforwards related to operations in Japan of $2.4 million which expire

in 2020, Brazil of $2.9 million which have an unlimited carryforward, Korea of $2.9 million which expire in 2024, and German trade tax of $0.7 million

which expire in 2018.

If future events change the outcome of the Company's projected return to profitability, a valuation allowance may not be required to reduce the

deferred tax assets. The Company will continue to assess the need for a valuation allowance.

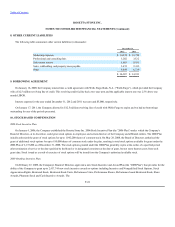

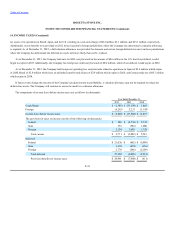

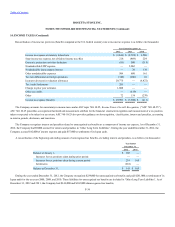

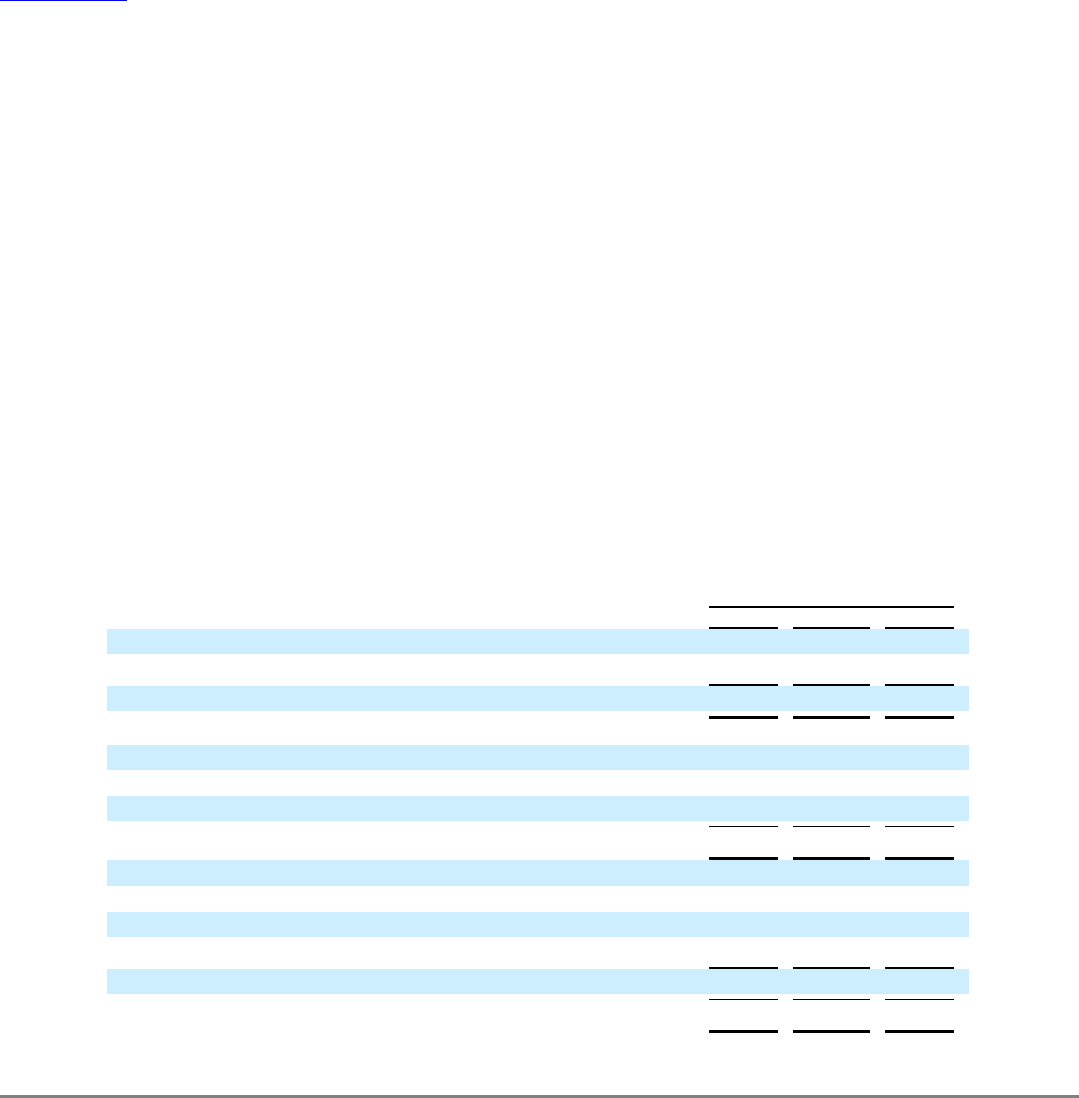

The components of income (loss) before income taxes are as follows (in thousands):

F-33

United States $ (1,585) $ (33,199) $ 1,683

Foreign (4,255) 5,231 11,190

Income (loss) before income taxes $ (5,840) $ (27,968) $ 12,873

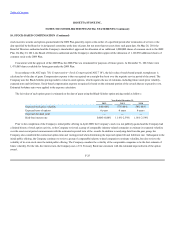

The provision for taxes on income consists of the following (in thousands):

Federal $ 288 $ (8,758) $ 2,739

State 333 (582) 1,066

Foreign 2,150 3,458 1,738

Total current $ 2,771 $ (5,882) $ 5,543

Deferred:

Federal $ 21,026 $ (682) $ (3,099)

State 3,418 (870) (456)

Foreign 2,776 (546) (2,399)

Total deferred 27,220 (2,098) (5,954)

Provision (benefit) for income taxes $ 29,991 $ (7,980) $ (411)