Rosetta Stone 2012 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2012 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

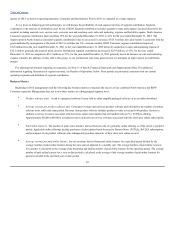

and which could adversely affect our operations and operating results. A number of factors may affect the market price for our common stock,

including: shortfalls in revenue, margins, earnings or key performance metrics, confusion on the part of industry analysts and investors about the impact

of our subscription offerings, shortfalls in the number of subscribers, changes in analyst estimates or recommendations, new product announcements by

competitors, seasonal variations in demand, loss of a large customer, variations in competitors' financial performance and regulatory or macro-economic

effects.

Provisions in our second amended and restated certificate of incorporation and second amended and restated bylaws, and in the Delaware General

Corporation Law, may make it difficult and expensive for a third party to pursue a takeover attempt we oppose even if a change in control of our

company would be beneficial to the interests of our stockholders. Any provision of our second amended and restated certificate of incorporation or

second amended and restated bylaws or Delaware law that has the effect of delaying or deterring a change in control could limit the opportunity for our

stockholders to receive a premium for their shares of our common stock, and could also affect the price that some investors are willing to pay for our

common stock. Our board of directors has the authority to issue up to 10,000,000 shares of preferred stock in one or more series and to fix the powers,

preferences and rights of each series without stockholder approval. The ability to issue preferred stock could discourage unsolicited acquisition

proposals or make it more difficult for a third party to gain control of our company, or otherwise could adversely affect the market price of our common

stock. Further, as a Delaware corporation, we are subject to Section 203 of the Delaware General Corporation Law. This section generally prohibits us

from engaging in mergers and other business combinations with stockholders that beneficially own 15% or more of our voting stock, or with their

affiliates, unless our directors or stockholders approve the business combination in the prescribed manner. However, because funds affiliated with ABS

Capital Partners and Norwest acquired their shares prior to our initial public offering, Section 203 is currently inapplicable to any business combination

or transaction with them or their affiliates. In addition, our second amended and restated certificate of incorporation includes a classified board of

directors and requires that any action to be taken by stockholders must be taken at a duly called meeting of stockholders and may not be taken by written

consent. Our second amended and restated bylaws require that any stockholder proposals or nominations for election to our board of directors must

meet specific advance notice requirements and procedures, which make it more difficult for our stockholders to make proposals or director nominations.

None.

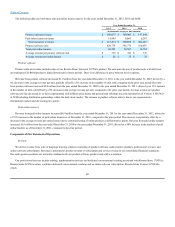

Our corporate headquarters are located in Arlington, Virginia, where we sublease approximately 31,281 square feet of space. The term of this

sublease was amended in the fourth quarter of 2012 and runs through December 31, 2018.

We continue to lease approximately 8,038 square feet of additional space in Arlington, Virginia, with lease terms ending August 31, 2013. We

intend to occupy this space until the end of the lease term.

We currently own two facilities with approximately 62,000 and 14,500 square feet of usable space in Harrisonburg, Virginia, that serve as our

operations offices. In addition, we lease two facilities with

32