Rosetta Stone 2012 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2012 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

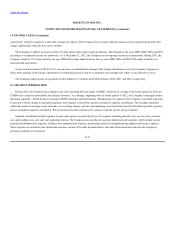

From time to time, the Company has been subject to various claims and legal actions in the ordinary course of its business. The Company is not

currently involved in any legal proceeding the ultimate outcome of which, in its judgment based on information currently available, would have a

material impact on its business, financial condition or results of operations.

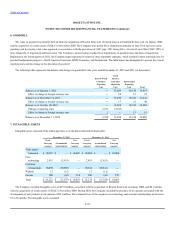

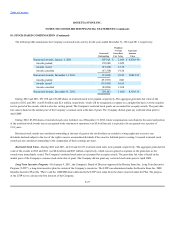

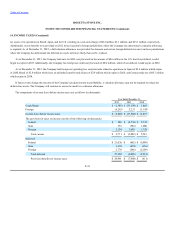

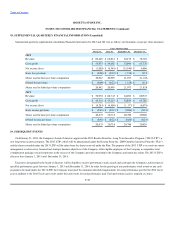

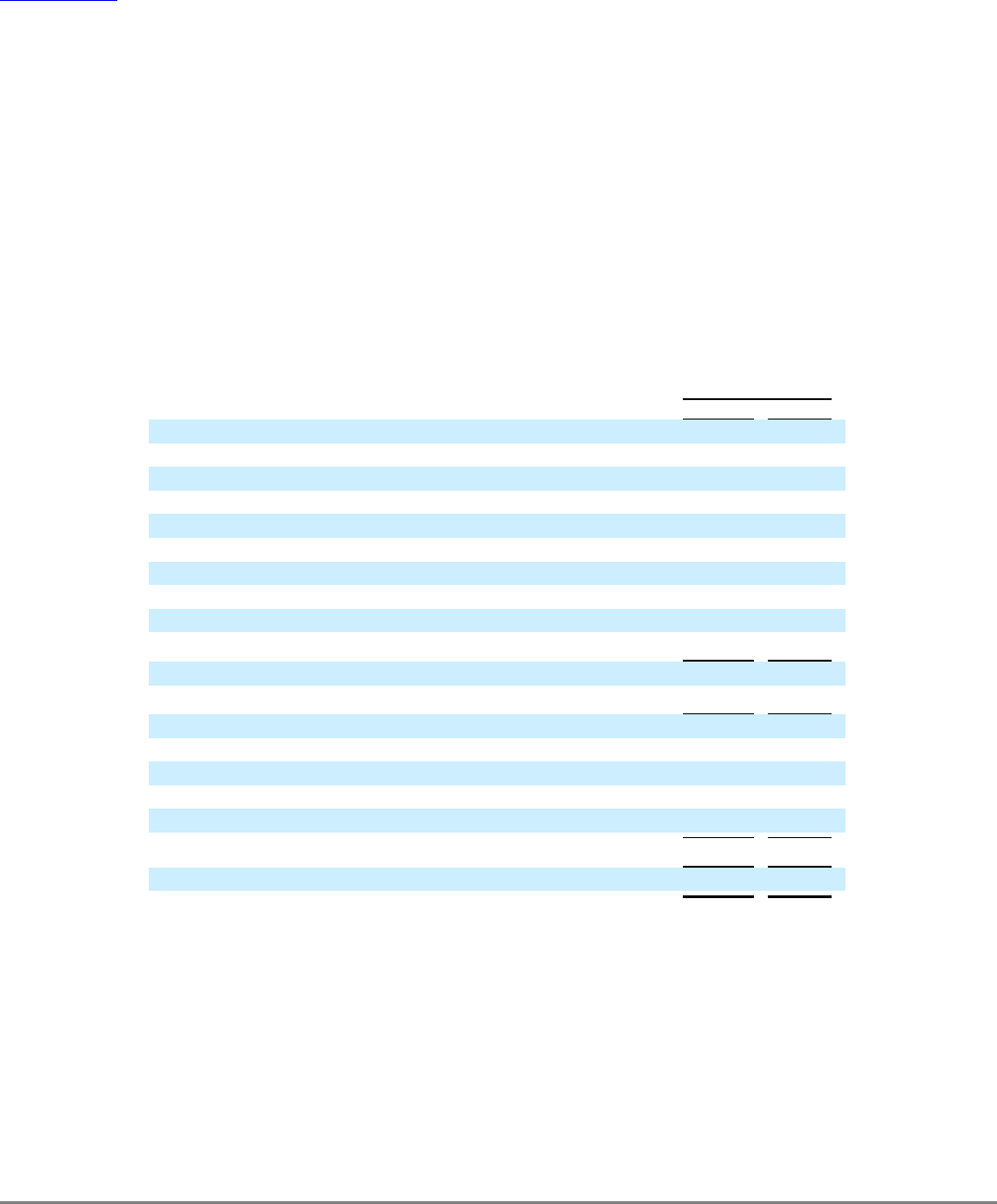

The following table summarizes the significant components of the Company's deferred tax assets and liabilities as of December 31, 2012 and 2011

(in thousands):

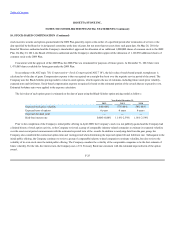

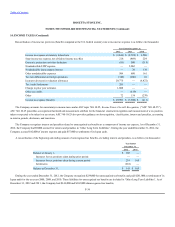

During the quarter ended December 31, 2010, the Company determined that the relative weight of positive and negative evidence supported that it

is more likely than not that the deferred tax assets relating to foreign operations will be realized and accordingly the Company released its valuation

allowance. The Company had evaluated the valuation allowance on its foreign deferred tax assets quarterly prior to making the determination to release

the valuation allowance during the quarter ended December 31, 2010. As of December 31, 2011, the Company had fully utilized the net operating loss

("NOL") carryforwards for U.K. income tax purposes and the NOL carryforwards for Japanese income tax purposes upon which the valuation

allowance had been released.

During the second quarter of 2012, the Company established a full valuation allowance to reduce the deferred tax assets of the Korea subsidiary

resulting in a non-cash charge of $0.4 million. During the third quarter of 2012, the Company established a full valuation allowance to reduce the

deferred

F-32

Deferred tax assets:

Inventory $ 873 $ 478

Amortization and depreciation 7,273 7,710

Net operating loss carryforwards 3,107 1,002

Deferred revenue 2,548 1,826

Accrued liabilities 10,189 9,117

Stock-based compensation 5,613 4,271

Bad debt reserve 441 770

Foreign currency translation 286 77

Foreign and other tax credits 445 1,704

Gross deferred tax assets 30,775 26,955

Valuation allowance (29,671) —

Net deferred tax assets 1,104 26,955

Deferred tax liabilities:

Goodwill and indefinite lived intangibles (8,400) (7,201)

Prepaid expenses (759) (727)

Other (6) (4)

Gross deferred tax liabilities (9,165) (7,932)

Net deferred tax assets (liabilities) $ (8,061) $ 19,023