Rosetta Stone 2012 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2012 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

stage, in accordance with ASC topic 350, ("ASC 350").

Internal-use software is defined to have the following characteristics: (a) the software is internally developed, or modified solely to meet the entity's

internal needs, and (b) during the software's development or modification, no substantive plan exists or is being developed to market the software

externally. Internally developed software is amortized over a three-year useful life.

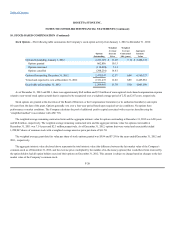

For the years ended December 31, 2012, 2011 and 2010, the Company capitalized $2.2 million, $2.5 million, and zero in internal-use software,

respectively.

For the years ended December 31, 2012, 2011 and 2010, the Company recorded amortization expense relating to internal-use software of

$0.9 million, $0.4 million, and $0.3 million.

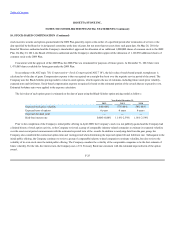

The Company accounts for income taxes in accordance with ASC topic 740, ("ASC 740"), which provides for an asset and liability

approach to accounting for income taxes. Deferred tax assets and liabilities represent the future tax consequences of the differences between the financial

statement carrying amounts of assets and liabilities versus the tax basis of assets and liabilities. Under this method, deferred tax assets are recognized for

deductible temporary differences, and operating loss and tax credit carryforwards. Deferred liabilities are recognized for taxable temporary differences.

Deferred tax assets are reduced by a valuation allowance when, in the opinion of management, it is more likely than not that some portion or all of the

deferred tax assets will not be realized. The impact of tax rate changes on deferred tax assets and liabilities is recognized in the year that the change is

enacted.

ASC 740 requires a reduction of the carrying amounts of deferred tax assets by a valuation allowance if, based on available evidence, it is more

likely than not that such assets will not be realized. Accordingly, the need to establish valuation allowances for deferred tax assets is assessed

periodically based on the ASC 740 more-likely-than-not realization ("MLTN") threshold criterion. In the assessment for a valuation allowance,

appropriate consideration is given to all positive and negative evidence related to the realization of the deferred tax assets. This assessment considers,

among other matters, the nature, frequency and severity of current and cumulative losses, forecasts of future profitability, the duration of statutory

carryforward periods, the Company's experience with operating loss and tax credit carryforwards not expiring unused, tax credits, and tax planning

alternatives.

Significant judgment is required to determine whether a valuation allowance is necessary and the amount of such valuation allowance, if

appropriate. The valuation allowance is reviewed at each reporting period and is maintained until sufficient positive evidence exists to support a reversal.

F-16