Rosetta Stone 2012 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2012 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

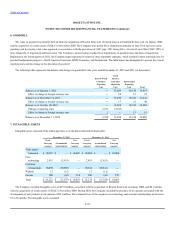

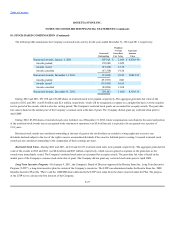

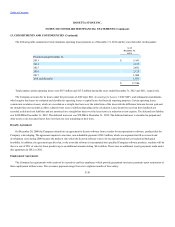

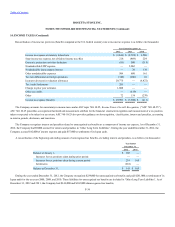

The following table summarizes the Company's restricted stock activity for the years ended December 31, 2012 and 2011, respectively:

During 2012 and 2011, 651,978 and 170,260 shares of restricted stock were granted, respectively. The aggregate grant date fair value of the

awards in 2012 and 2011 was $5.8 million and $2.4 million, respectively, which will be recognized as expense on a straight-line basis over the requisite

service period of the awards, which is also the vesting period. The Company's restricted stock grants are accounted for as equity awards. The grant date

fair value is based on the market price of the Company's common stock at the date of grant. The Company did not grant any restricted stock prior to

April 2009.

During 2012, 83,054 shares of restricted stock were forfeited. As of December 31, 2012, future compensation cost related to the nonvested portion

of the restricted stock awards not yet recognized in the statement of operations was $5.6 million and is expected to be recognized over a period of

2.18 years.

Restricted stock awards are considered outstanding at the time of grant as the stock holders are entitled to voting rights and to receive any

dividends declared subject to the loss of the right to receive accumulated dividends if the award is forfeited prior to vesting. Unvested restricted stock

awards are not considered outstanding in the computation of basic earnings per share.

—During 2012 and 2011, 44,241 and 22,227 restricted stock units were granted, respectively. The aggregate grant date fair

value of the awards in 2012 and 2011 was $0.6 million and $0.3 million, respectively, which was recognized as expense on the grant date, as the

awards were immediately vested. The Company's restricted stock units are accounted for as equity awards. The grant date fair value is based on the

market price of the Company's common stock at the date of grant. The Company did not grant any restricted stock units prior to April 2009.

—On January 4, 2011, the Company's Board of Directors approved the Rosetta Stone Inc. Long Term Incentive

Program ("LTIP"), a long-term incentive plan for certain of the Company's executives. The LTIP was administered under the Rosetta Stone Inc. 2009

Omnibus Incentive Plan (the "Plan"), and the 1,000,000 shares allocated to the LTIP were taken from the shares reserved under the Plan. The purpose

of the LTIP was to: advance the best interests of the Company;

F-27

Nonvested Awards, January 1, 2011 307,524 $ 21.69 $ 6,670,196

Awards granted 170,260 14.09

Awards vested (87,436) 21.58

Awards cancelled (67,338) 19.26

Nonvested Awards, December 31, 2011 323,010 18.22 5,885,242

Awards granted 651,978 8.88

Awards vested (133,831) 16.85

Awards cancelled (83,054) 12.68

Nonvested Awards, December 31, 2012 758,103 11.00 8,339,133