Rosetta Stone 2012 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2012 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

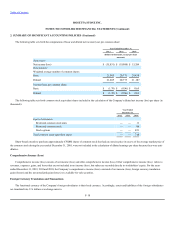

effect on the balance sheet date. Income and expense items are translated at average rates for the period. Translation adjustments are recorded as a

component of other comprehensive income (loss) in stockholders' equity.

Cash flows of consolidated foreign subsidiaries, whose functional currency is the local currency, are translated to U.S. dollars using average

exchange rates for the period. The Company reports the effect of exchange rate changes on cash balances held in foreign currencies as a separate item in

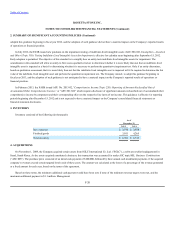

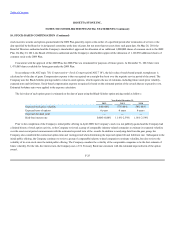

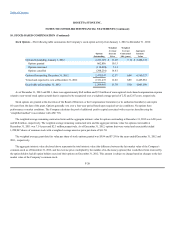

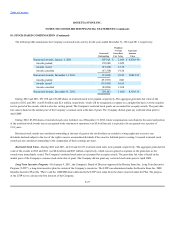

the reconciliation of the changes in cash and cash equivalents during the period. The following table presents the effect of exchange rate changes and the

net unrealized gains and losses from the available-for-sale securities on total comprehensive income (loss) (dollars in thousands):

Costs for advertising are expensed as incurred. Advertising expense for the years ended December 31, 2012, 2011, and 2010 were $66.2 million,

$74.4 million, and $54.2 million, respectively.

In June 2011, the FASB issued new guidance on comprehensive income statement presentation (ASU 2011-05—

. Under the amendments to Topic 220, an entity has the option to present the total of comprehensive income, the components of net income, and

the components of other comprehensive income either in a single continuous statement of comprehensive income or in two separate but consecutive

statements. In both choices, an entity is required to present each component of net income along with total net income, each component of other

comprehensive income along with a total for other comprehensive income, and a total amount for comprehensive income. This update eliminates the

option to present the components of other comprehensive income as part of the statement of changes in stockholders' equity. The amendments in this

update do not change the items that must be reported in other comprehensive income or when an item of other comprehensive income must be

reclassified to net income, thus the adoption of such standard did not have a material impact on the Company's reported results of operations and

financial position.

In September 2011, the FASB issued new guidance on goodwill impairment testing (ASU 2011-08,

), effective for calendar years beginning after December 15, 2011. Early adoption is permitted. The objective of

this standard is to simplify how an entity tests goodwill for impairment. The amendments in this standard will allow an entity to first assess qualitative

factors to determine whether it is more likely than not that the fair value of a reporting unit is less than its carrying value as a basis for determining

whether it needs to perform the quantitative two-step goodwill impairment test. Only if an entity determines, based on qualitative assessment, that it is

more likely than not that a reporting unit's fair value is less than its carrying value will it be required to calculate the fair value of the reporting unit. The

Company

F-19

Net income (loss) $ (35,831) $ (19,988) $ 13,284

Foreign currency translation gain (loss) 336 98 447

Unrealized gain (loss) on available-for-sale securities 23 (23) —

Total comprehensive income (loss) $ (35,472) $ (19,913) $ 13,731