Redbox 2010 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2010 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

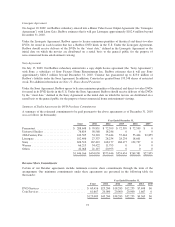

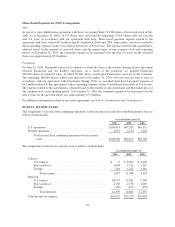

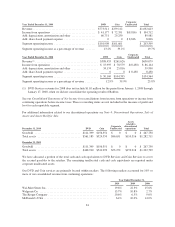

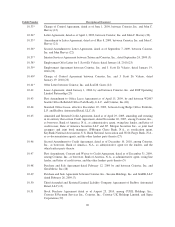

Revenue is allocated to geographic locations based on the location of the DVD Services or Coin Services kiosk.

Revenue by geographic location was as follows (in thousands):

Year Ended December 31,

2010 2009 2008

U.S. ........................................................ $1,395,821 $ 995,884 $611,644

All other .................................................... 40,600 36,739 38,435

Total ................................................... $1,436,421 $1,032,623 $650,079

Long-lived assets by geographic location were as follows (in thousands):

December 31,

2010 2009 2008

U.S. ........................................................ $775,208 $765,124 $577,916

All other .................................................... 19,109 17,598 14,079

Total ................................................... $794,317 $782,722 $591,995

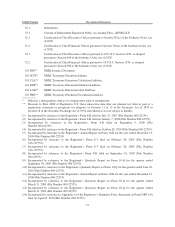

NOTE 16: RELATED PARTY AND OTHER TRANSACTIONS

In the second quarter of 2008, we settled a proxy contest, which resulted in one additional member to our Board

of Directors, and one additional independent director to be added by March 1, 2009. Expenses related to this

proxy contest, including the solicitation of stockholders, were approximately $4.1 million.

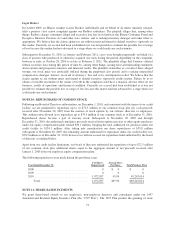

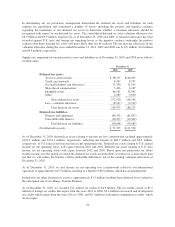

NOTE 17: DERIVATIVE INSTRUMENTS

Interest Rate Swaps

As of December 31, 2010, we had one interest rate swap agreement outstanding to hedge against the potential

impact on earnings from an increase in market interest rates associated with the interest payments on our

variable-rate revolving credit facility with Wells Fargo Bank for a notional amount of $150.0 million with an

expiration date of March 20, 2011. Our previously outstanding interest rate swap agreement with JP Morgan

Chase for a notional amount of $75.0 million with an expiration date of October 28, 2010 was terminated on

August 4, 2010 as the underlying revolving debt of $75.0 million was paid off. The fair value of the interest rate

swap at the time of the termination was a liability of $0.4 million, which was reversed from comprehensive

income (loss) and recognized as interest expense in our Consolidated Statements of Net Income during the third

quarter of 2010.

Under the interest rate swap agreement, we receive or make payments on a monthly basis, based on the

differential between a specific interest rate and one-month LIBOR. The interest rate swap is accounted for as a

cash flow hedge. The fair value of the swaps, which was a liability of $0.9 million and $5.4 million at

December 31, 2010 and 2009, respectively, was recorded as a component of other accrued liabilities in our

Consolidated Balance Sheets, with a corresponding adjustment to comprehensive income (loss). Estimated losses

in accumulated comprehensive income (loss) at December 31, 2010 are expected to be reclassified into earnings

as a component of interest expense over the next three months. All gains and losses were included in

management’s assessment of hedge effectiveness and the amount of the net gain or loss included in our

Consolidated Statements of Net Income representing the amount of hedge ineffectiveness was inconsequential in

all periods presented.

82