Redbox 2010 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2010 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

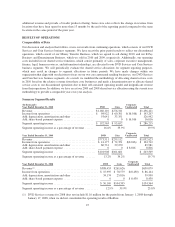

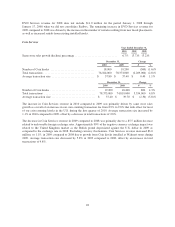

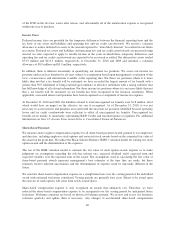

Year Ended December 31, Change

2009 2008 $ %

DVD Services ................................................ $ 969 $1,026 $(57) (5.6)%

Coin Services ................................................. 2,594 2,540 54 2.1%

Total .................................................... $3,563 $3,566 $ (3) (0.1)%

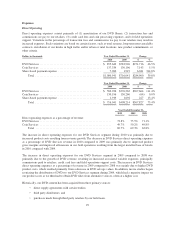

Year Ended December 31,

2010 2009 2008

Amortization as a percentage of revenue:

DVD Services ....................................................... 0.1% 0.1% 0.3%

Coin Services ........................................................ 0.9% 1.0% 1.0%

Total ........................................................... 0.2% 0.3% 0.5%

Unamortized intangible assets totaled $9.6 million at December 31, 2010 and will be amortized at the rate of

approximately $0.7 million per quarter in 2011, $0.6 million per quarter in 2012 and 2013, $0.4 million per

quarter in 2014 and the remaining balance of $0.4 million will be amortized thereafter.

Litigation Settlement

In April 2010, we settled patent litigation with ScanCoin for $5.4 million, inclusive of $2.1 million in legal costs

previously capitalized in anticipation of a successful defense of the patents. The entire settlement was expensed

during the first quarter of 2010.

Interest Expense

Interest expense in 2010 and 2009 includes interest expense related to our $200 million convertible senior notes,

which includes both cash interest expense and non-cash interest expense for the amortization of the related debt

issuance and debt discount costs. The unamortized debt issuance and debt discount as of December 31, 2010 was

$26.9 million and will be recognized as non-cash interest expense over the remaining life of the notes in the

amount of $6.6 million in 2011, $7.1 million in 2012, $7.7 million in 2013, and $5.5 million in 2014. Interest

expense in 2009 and 2008 included interest expense related to our $87.5 million term loan until its early

retirement due to the issuance of our $200 million convertible senior notes in September 2009.

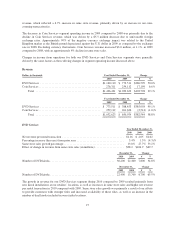

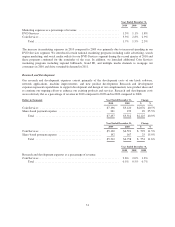

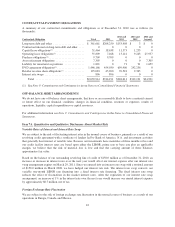

Dollars in thousands Year Ended December 31, Change

2010 2009 $ %

Cash interest expense .................................... $26,408 $30,566 $ (4,158) (13.6)%

Non-cash interest expense ................................ 8,456 3,682 4,774 129.7%

Total interest expense ............................... $34,864 $34,248 $ 616 1.8%

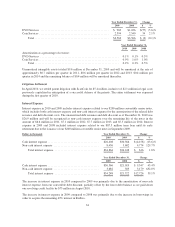

Year Ended December 31, Change

2009 2008 $ %

Cash interest expense .................................... $30,566 $21,019 $ 9,547 45.4%

Non-cash interest expense ................................ 3,682 503 3,179 632.0%

Total interest expense ............................... $34,248 $21,522 $12,726 59.1%

The increase in interest expense in 2010 compared to 2009 was primarily due to the amortization of non-cash

interest expense from our convertible debt discount, partially offset by the lower debt balance as we paid down

our revolving credit facility by $75 million in August 2010.

The increase in interest expense in 2009 compared to 2008 was primarily due to the increase in borrowings in

order to acquire the remaining 49% interest in Redbox.

34