Redbox 2010 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2010 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

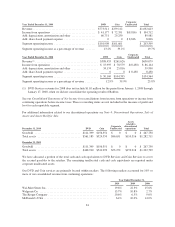

In determining our tax provisions, management determined the deferred tax assets and liabilities for each

separate tax jurisdiction and considered a number of factors including the positive and negative evidence

regarding the realization of our deferred tax assets to determine whether a valuation allowance should be

recognized with respect to our deferred tax assets. The consolidated deferred tax asset valuation allowance was

$8.9 million and $9.9 million, respectively, as of December 31, 2010 and 2009. A valuation allowance has been

recorded against U.S. state and foreign net operating losses as the negative evidence outweighs the positive

evidence that those deferred tax assets will more likely than not be realized. The net increase (decrease) in the

valuation allowance during the years ended December 31, 2010, 2009 and 2008 was $(1.0) million, $3.0 million

and $4.4 million, respectively.

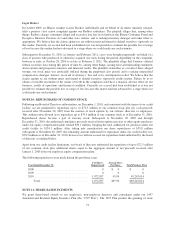

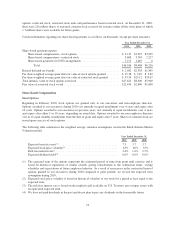

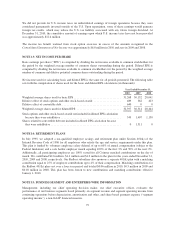

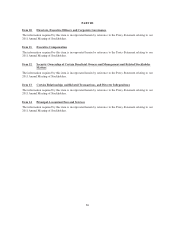

Significant components of our deferred tax assets and liabilities as of December 31, 2010 and 2009 are as follows

(in thousands):

December 31,

2010 2009

Deferred tax assets:

Tax loss carryforwards ....................... $ 98,137 $116,013

Credit carryforwards ......................... 4,907 8,197

Accrued liabilities and allowances .............. 13,330 11,914

Share-based compensation .................... 5,416 4,167

Intangible assets ............................ 46,141 52,045

Other ..................................... 4,989 3,810

Gross deferred tax assets .................. 172,920 196,146

Less—valuation allowance .................... (8,947) (9,929)

Total deferred tax assets .................. 163,973 186,217

Deferred tax liabilities:

Property and equipment ...................... (80,331) (61,857)

Convertible debt interest ...................... (10,317) (12,832)

Total deferred tax liabilities ............... (90,648) (74,689)

Net deferred tax assets ............................ $ 73,325 $111,528

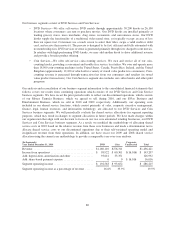

As of December 31, 2010, deferred tax assets relating to income tax loss carryforwards included approximately

$241.9 million and $191.3 million, respectively, reflecting the benefit of $84.7 million and $6.5 million,

respectively, of U.S. federal and state income tax net operating losses. Deferred tax assets relating to U.S. federal

income tax net operating losses will expire between 2022 and 2030. Deferred tax assets relating to U.S. state

income tax net operating losses will expire between 2012 and 2030. Based upon our projections for future

taxable income over the periods in which the deferred tax assets are deductible, we believe it is more likely than

not that we will realize the benefits of these deductible differences, net of the existing valuation allowances at

December 31, 2010.

As of December 31, 2010, we had income tax net operating loss carryforwards related to our international

operations of approximately $27.9 million, resulting in a benefit of $6.9 million, which has an indefinite life.

Included in our other deferred tax assets is approximately $3.5 million resulting from deferred losses related to

the anticipated sale of our Money Transfer Business.

As of December 31, 2010, we recorded U.S. federal tax credits of $4.9 million. The tax credits consist of $1.9

million of foreign tax credits that expire from the years 2014 to 2020, $2.3 million of research and development

tax credits which expire from the years 2011 to 2030, and $0.7 million of alternative minimum tax credits, which

do not expire.

78