Redbox 2010 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2010 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Recognition and Reporting of Business Dispositions

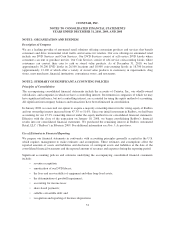

When management commits to a plan to dispose of a business component, it is necessary to determine how the

results will be presented within the financial statements and whether the net assets of that business are

recoverable. Our significant accounting policies and judgments associated with a decision to dispose of a

business are as follows:

• Assets held for sale—We define a business component as held for sale if it meets the requirement of

assets held for sale, in accordance with ASC 360-10, at the balance sheet date. Upon being classified as

held for sale, the carrying value of the business component must be assessed, and the business

component held for sale is reported at the lower of its carrying value or estimated fair value less cost to

sell.

• Discontinued operations—We define a business component that has either been disposed of or is

classified as held for sale as discontinued operations if its operations and cash flows are clearly

distinguishable from the rest of the entity; its operations and cash flows have been or will be eliminated

from ongoing operations of the entity as a result of the disposal; and we have no significant continuing

involvement in the operations of the component after the disposal transaction. If a component is

recorded as discontinued operations, the results of operations of the disposed business through the date

of sale and the gain or loss on disposal are presented on a separate line in the income statement for all

periods presented.

For additional information see Note 4: Discontinued Operations, Sale of Assets and Assets Held for Sale.

Recent Accounting Guidance

In January 2010, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update

No. 2010-06, Fair Value Measurements and Disclosures (Topic 820): Improving Disclosures about Fair Value

Measurements (“ASU 2010-06”).ASU-2010-06 requires some new disclosures and clarifies some existing

disclosure requirements about fair value measurement as set forth in Accounting Standards Codification Subtopic

820-10: Fair Value. ASU 2010-06 amends Codification Subtopic 820-10 and now requires a reporting entity to

use judgment in determining the appropriate classes of assets and liabilities and to provide disclosures about the

valuation techniques and inputs used to measure fair value for both recurring and nonrecurring fair value

measurements. ASU 2010-06 was effective for our Company beginning January 1, 2010 and did not have a

material effect on our results of operations, financial position or cash flows.

In October 2009, the FASB issued Accounting Standard Update 2009-13, Multiple-Deliverable Arrangements

(“ASU 2009-13”) which amended ASC Topic 605, Revenue Recognition, by establishing a hierarchy for

determining the value of each element within a multiple deliverable arrangement. ASU 2009-13 is effective

prospectively for us beginning January 1, 2011 and applies to arrangements entered into on or after that date. Our

adoption of this guidance will not have a material effect on our results of operations, financial position or cash

flows.

Reclassifications

To be consistent with our 2010 reporting, we have reclassified certain balances in our Consolidated Balance

Sheets as of December 31, 2009 related to our electronic payment services business (the “E-Pay Business”) and

money transfer services business (the “Money Transfer Business”) to assets and liabilities of businesses held for

sale. In addition, results from our discontinued operations have been retrospectively reported in the Consolidated

Statements of Net Income and Consolidated Statements of Cash Flows for all periods presented. Our

reclassifications had no effect on net income or stockholders’ equity.

59