Redbox 2010 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2010 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.expense are recognized in the period of change. If actual forfeitures differ significantly from our estimates, our

results of operations could be materially impacted. For additional information see Note 11: Share-Based

Payments in the Notes to Consolidated Financial Statements.

Callable Convertible Debt

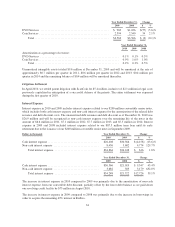

In September 2009, we issued $200 million aggregate principal amount of 4% Convertible Senior Notes (the

“Notes”). We have separately accounted for the liability and the equity components of the Notes based on the

estimated fair value of the debt upon issuance. As one of the conversion events was met on December 31, 2010,

the Notes became convertible in and for the first quarter of 2011 and are reported within the current liability

section in our Consolidated Balance Sheets. The related debt conversion feature was recorded as such in our

Consolidated Balance Sheets. For additional information see Note 8: Debt in our Notes to Consolidated

Financial Statements.

Recognition and Reporting of Business Dispositions

When management commits to a plan to dispose of a business component, it is necessary to determine how the

results will be presented within the financial statements and whether the net assets of that business are

recoverable. Our significant accounting policies and judgments associated with a decision to dispose of a

business are as follows:

• Assets held for sale—We define a business component as held for sale if it meets the requirement of

assets held for sale, in accordance with Accounting Standards Codification (“ASC”) 360-10, at the

balance sheet date. Upon being classified as held for sale, the carrying value of the business component

must be assessed, and the business component held for sale is reported at the lower of its carrying value

or estimated fair value less cost to sell.

• Discontinued operations—We define a business component that has either been disposed of or is

classified as held for sale as discontinued operations if its operations and cash flows are clearly

distinguishable from the rest of the entity; its operations and cash flows have been or will be eliminated

from ongoing operations of the entity as a result of the disposal; and we have no significant continuing

involvement in the operations of the component after the disposal transaction. If a component is

recorded as discontinued operations, the results of operations of the disposed business through the date

of sale and the gain or loss on disposal are presented on a separate line in the income statement for all

periods presented.

For additional information see Note 4: Discontinued Operations, Sale of Assets and Assets Held for Sale in the

Notes to Consolidated Financial Statements.

RECENT ACCOUNTING GUIDANCE

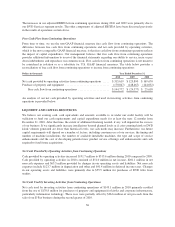

In October 2009, the FASB issued Accounting Standard Update 2009-13, Multiple-Deliverable Arrangements

(“ASU 2009-13”), which amended ASC Topic 605, Revenue Recognition by establishing a hierarchy for

determining the value of each element within a multiple deliverable arrangement. ASU 2009-13 is effective

prospectively for us beginning January 1, 2011 and applies to arrangements entered into on or after that date. Our

adoption of this guidance will not have a material effect on our results of operations, financial position or cash

flows.

41