Redbox 2010 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2010 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

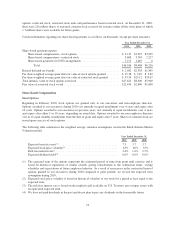

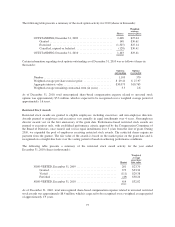

options, restricted stock, restricted stock units and performance based restricted stock. At December 31, 2010,

there were 2.8 million shares of unissued common stock reserved for issuance under all the stock plans of which

1.7 million shares were available for future grants.

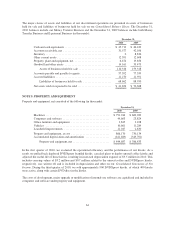

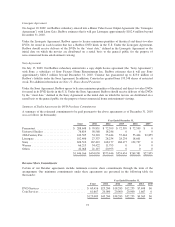

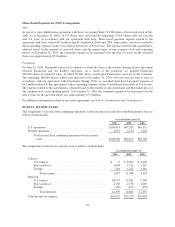

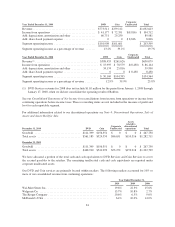

Certain information regarding our share-based payments is as follows (in thousands, except per share amounts):

Year Ended December 31,

2010 2009 2008

Share-based payment expense:

Share-based compensation—stock options ............................. $ 3,137 $3,295 $3,999

Share-based compensation—restricted stock ............................ 5,608 3,763 2,217

Share-based payments for DVD arrangements .......................... 7,271 1,410 0

Total ....................................................... $16,016 $8,468 $6,216

Related deferred tax benefit ............................................. $ 2,982 $2,338 $1,845

Per share weighted average grant date fair value of stock options granted ......... $ 15.38 $ 9.49 $ 9.62

Per share weighted average grant date fair value of restricted stock granted ....... $ 33.34 $29.12 $33.67

Total intrinsic value of stock options exercised .............................. $27,622 $8,400 $5,900

Fair value of restricted stock vested ....................................... $12,456 $2,600 $1,600

Share-Based Compensation

Stock Options

Beginning in February 2010, stock options are granted only to our executives and non-employee directors.

Options awarded to our executives during 2010 vest annually in equal installments over 4 years and expire after

10 years. Options awarded to our executives in previous years vest annually in equal installments over 4 years

and expire after either 5 or 10 years, depending on award date. Options awarded to our non-employee directors

vest in 12 equal monthly installments from the date of grant and expire after 5 years. Shares of common stock are

issued upon exercise of stock options.

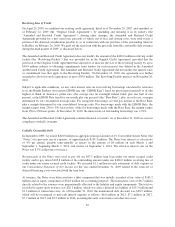

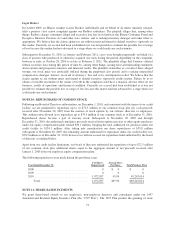

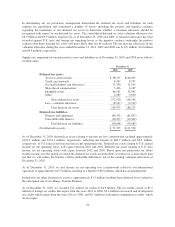

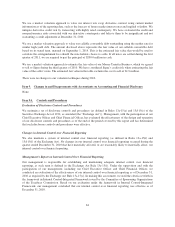

The following table summarizes the weighted average valuation assumptions used in the Black-Scholes-Merton

Valuation model:

Year Ended December 31,

2010 2009 2008

Expected term (in years)(1) ........................................ 7.3 3.7 3.7

Expected stock price volatility(2) .................................... 43% 40% 35%

Risk-free interest rate(3) ........................................... 2.4% 1.6% 2.5%

Expected dividend yield(4) ......................................... 0.0% 0.0% 0.0%

(1) The expected term of the options represents the estimated period of time from grant until exercise and is

based on historical experience of similar awards, giving consideration to the contractual terms, vesting

schedules and expectations of future employee behavior. As a result of an increase in the contractual term of

options granted to our executives during 2010 compared to prior periods, we revised the expected term

assumption during 2010.

(2) Expected stock price volatility is based on historical volatility of our stock for a period at least equal to the

expected term.

(3) The risk-free interest rate is based on the implied yield available on U.S. Treasury zero-coupon issues with

an equivalent expected term.

(4) We have not paid dividends in the past and do not plan to pay any dividends in the foreseeable future.

74