Redbox 2010 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2010 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

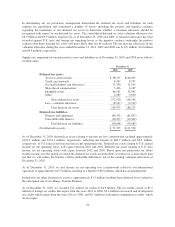

We did not provide for U.S. income taxes on undistributed earnings of foreign operations because they were

considered permanently invested outside of the U.S. Upon repatriation, some of these earnings would generate

foreign tax credits, which may reduce the U.S. tax liability associated with any future foreign dividend. At

December 31, 2010, the cumulative amount of earnings upon which U.S. income taxes have not been provided

was approximately $12.6 million.

The income tax benefit realized from stock option exercises in excess of the amounts recognized in the

Consolidated Statements of Net Income was approximately $6.8 million in 2010 and zero in 2009 and 2008.

NOTE 13: NET INCOME PER SHARE

Basic earnings per share (“EPS”) is computed by dividing the net income available to common stockholders for

the period by the weighted average number of common shares outstanding during the period. Diluted EPS is

computed by dividing the net income available to common stockholders for the period by the weighted average

number of common and dilutive potential common shares outstanding during the period.

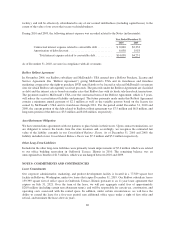

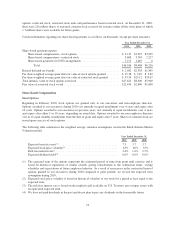

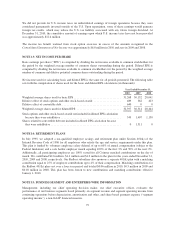

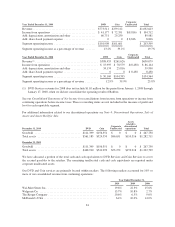

Net income used for calculating basic and diluted EPS is the same for all periods presented. The following table

sets forth the computation of shares used for the basic and diluted EPS calculations (in thousands):

Year Ended December 31,

2010 2009 2008

Weighted average shares used for basic EPS ................................. 31,268 30,152 28,041

Dilutive effect of stock options and other stock-based awards ................... 489 362 423

Dilutive effect of convertible debt ......................................... 640 0 0

Weighted average shares used for diluted EPS ............................... 32,397 30,514 28,464

Stock options and other stock-based awards not included in diluted EPS calculation

because they were antidilutive .......................................... 349 1,407 1,150

Shares related to convertible debt not included in diluted EPS calculation because

they were antidilutive ................................................. 0 1,511 0

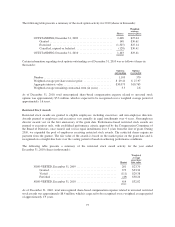

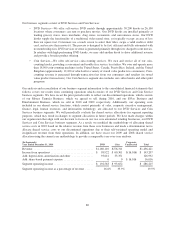

NOTE 14: RETIREMENT PLANS

In July 1995, we adopted a tax-qualified employee savings and retirement plan under Section 401(k) of the

Internal Revenue Code of 1986 for all employees who satisfy the age and service requirements under this plan.

This plan is funded by voluntary employee salary deferral of up to 60% of annual compensation (subject to the

Federal limitation) and a safe harbor employer match equaling 100% of the first 3% and 50% of the next 2%.

Additionally, all participating employees are 100% vested for all Coinstar matched contributions on the day of

match. We contributed $2.6 million, $1.4 million and $1.2 million to the plan for the years ended December 31,

2010, 2009 and 2008, respectively. Our Redbox subsidiary also sponsors a separate 401(k) plan with a matching

contribution equal to 25% of employee contributions up to 4% of their compensation. Matching contributions for

the Redbox 401(k) plan vest over a four-year period and totaled $0.06 million in 2010, $0.5 million in 2009 and

$0.18 million in 2008. This plan has been frozen to new contributions and matching contributions effective

January 1, 2010.

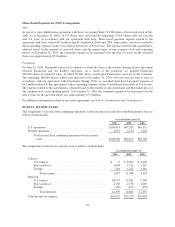

NOTE 15: BUSINESS SEGMENT AND ENTERPRISE-WIDE INFORMATION

Management, including our chief operating decision maker, our chief executive officer, evaluates the

performance of our business segments based primarily on segment revenue and segment operating income from

continuing operations before depreciation, amortization and other, and share-based payment expense (“segment

operating income”), a non-GAAP financial measure.

79