Redbox 2010 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2010 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion and analysis should be read in conjunction with our consolidated financial statements

and related notes thereto included elsewhere in this Annual Report. Except for the consolidated historical

information, the following discussion contains forward-looking statements. Actual results could differ from those

projected in the forward-looking statements. Please refer to “Special Note Regarding Forward-Looking

Statements” and “Risk Factors” elsewhere in this Annual Report.

OVERVIEW

We are a leading provider of automated retail solutions offering convenient products and services that benefit

consumers and drive incremental retail traffic and revenue for retailers. Our core offerings in automated retail

include our DVD Services business where consumers can rent or purchase movies from self-service kiosks and

our Coin business where consumers can convert their coin to cash or stored value products at coin-counting self-

service kiosks. Our DVD Services business generates revenue primarily through fees charged to rent or purchase

a DVD movie, and we pay retailers a percentage of our revenue. Our Coin Services business generates revenue

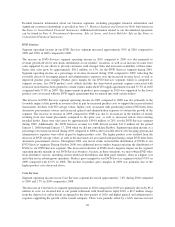

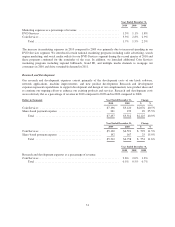

through transaction fees from our consumers and retailers. As compared to the previous period, our consolidated

revenue increased $403.8 million or 39.1% during 2010 and $382.5 million or 58.8% during 2009. These

increases were primarily due to growth in our DVD Services segment.

Our strategy is based upon leveraging our core competencies in the automated retail space to provide the

consumer with convenience and value and to help retailers drive incremental traffic and revenue. Our

competencies include success in building strong consumer and retailer relationships, and in deploying, scaling

and managing kiosk businesses. We build strong consumer relationships by providing valuable self-service

products and services in convenient locations. We build strong retailer relationships by providing retailers with

turnkey solutions that complement their businesses without significant outlays of time and financial resources.

We are focusing on growing our core businesses and the development of innovative new concepts in the

automated retail space through organic growth and external investment. We will also continue to expand our use

of social media to drive awareness of our offerings and continue to leverage new and innovative ideas to drive

demand. In order to support growth, we also expect to continue devoting significant resources to continuing to

develop our infrastructure including information technology systems and technology infrastructure necessary to

support our products and services.

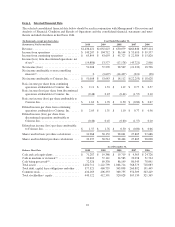

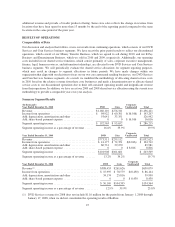

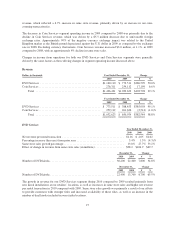

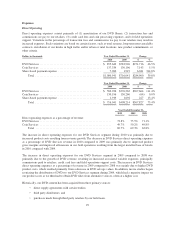

We manage our business by evaluating the financial results of our business segments, focusing primarily on

segment revenue and segment operating income from continuing operations before depreciation, amortization

and other and share-based payments (“segment operating income”), a non-GAAP financial measure. Segment

operating income contains internally allocated costs of shared service functions, including corporate executive

management, business development, sales, finance, legal, human resources, information technology and risk

management. We also review depreciation and amortization allocated to each segment.

We utilize segment revenue and segment operating income because we believe they provide useful information

for effectively allocating resources among business segments, evaluating the health of our business segments

based on metrics that management can actively influence, and gauging our investments and our ability to service,

incur or pay down debt. Specifically, our CEO evaluates segment revenue and segment operating income, and

assesses the performance of each business segment based on these measures, as well as, among other things, the

prospects of each of the segments and how they fit into our overall strategy. Our CEO then decides how

resources should be allocated among our business segments. For example, if a segment’s revenue increases more

than expected, our CEO may consider allocating more financial or other resources to that segment in the future.

We continually evaluate the shared service allocation methods used for segment reporting purposes, and this may

result in changes to segment allocations in future periods.

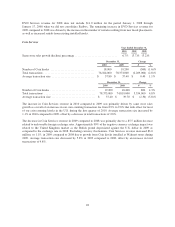

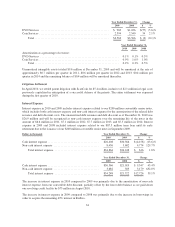

We also review same store sales which we calculate for our segments on a location basis. Most of our locations

have a single kiosk, but in locations with high performing kiosks, we may add additional kiosks to drive

24