Redbox 2010 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2010 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOTE 3: ACQUISITIONS

Redbox

In January 2008, we exercised our option to acquire a majority ownership interest in the voting equity of Redbox

and our ownership interest increased from 47.3% to 51.0%. Since our initial investment in Redbox, we had

accounted for our 47.3% ownership interest under the equity method in our consolidated financial statements.

Effective with the close of the transaction on January 18, 2008, we began consolidating Redbox’s financial

results into our consolidated financial statements.

On February 26, 2009, we closed the transaction (the “GAM Transaction”), whereby we agreed under a Purchase

and Sale Agreement (the “GAM Purchase Agreement”) with GetAMovie, Inc. (“GAM”) to acquire (i) GAM’s

44.4% voting interests (the “Interests”) in Redbox and (ii) GAM’s right, title and interest in a Term Promissory

Note dated May 3, 2007 made by Redbox in favor of GAM in the principal amount of $10.0 million (the “Note”),

in exchange for $10.0 million of cash and 1.5 million shares of our common stock with a value of

$27.7433 per share (and a total value of $41.6 million) based on the average of the volume weighted average

price per share for each of the eight NASDAQ trading days prior to, but not including, the date of issuance. The

remaining purchase price of $86.1 million plus interest of $2.3 million was paid in cash during the second and

third quarters of 2009.

In addition, also on February 26, 2009, we purchased the remaining outstanding interests of Redbox from

non-controlling interest and non-voting interest holders in Redbox under similar terms to those of the GAM

Purchase Agreement, issuing 146,039 unregistered shares of our common stock, 101,863 previously registered

shares of our common stock and $0.1 million in cash, totaling $6.9 million. The consideration paid in shares of

our common stock was valued in the same manner as the shares of common stock paid to GAM. The remaining

purchase price of $15.1 million plus interest of $0.4 million was paid in cash during the second and third quarters

of 2009.

The consideration totaled $162.4 million and included interest of $2.7 million. Of the total consideration,

$113.9 million was paid in cash and $48.5 million was paid in our common stock.

The purchase of the non-controlling interest in Redbox was a change of our ownership interest in a previously

consolidated subsidiary and was accounted for as an equity transaction. Accordingly, there was no gain or loss

recorded in our consolidated financial statements. The difference between the fair value of the total consideration

at closing and the carrying value of the non-controlling interest was recognized as a reduction to equity. This

difference of $112.5 million is being amortized over fifteen years for tax purposes, which resulted in tax benefits

of $43.8 million in the future years and offset the reduction to the equity attributable to Coinstar. In addition, we

made an Internal Revenue Service (“IRS”) code section 754 election resulting in an additional deferred tax

benefit of $11.9 million, which further offset the reduction in equity. As a result of recognizing these two tax

benefits, totaling $55.7 million, the net amount recorded as a reduction to our equity section was $56.8 million.

As of December 31, 2010 and 2009, the net difference was $56.3 million in the equity section of our

Consolidated Balance Sheets.

NOTE 4: DISCONTINUED OPERATIONS, SALE OF ASSETS AND ASSETS HELD FOR SALE

Money Transfer Business

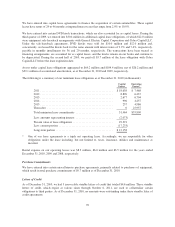

On August 23, 2010, we agreed to sell our Money Transfer Business, including subsidiaries, consisting GroupEx

Financial Corporation, JRJ Express Inc. and Kimeco, LLC (collectively, “GroupEx”), acquired in 2008, to Sigue

Corporation (“Sigue”). The sale price was $18.0 million in cash and a seller’s note for $23.5 million, adjusted for

the amount by which the closing net working capital of the Money Transfer Business exceeds or falls below $9.0

million. In addition, Sigue will pay us an amount equal to the amount outstanding at closing under the revolving

credit arrangement between us and the Money Transfer Business. We expect the sale to close in 2011.

60