Redbox 2010 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2010 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

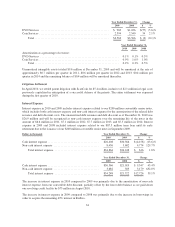

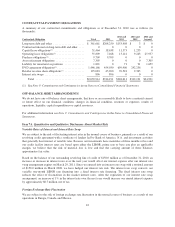

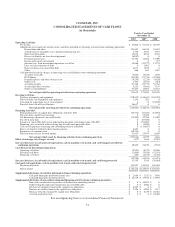

CONTRACTUAL PAYMENT OBLIGATIONS

A summary of our contractual commitments and obligations as of December 31, 2010 was as follows (in

thousands):

Contractual Obligation Total 2011

2012 and

2013

2014 and

2015

2016 and

beyond

Long-term debt and other ...................... $ 361,661 $208,250 $153,408 $ 3 $ 0

Contractual interest on long-term debt and other .... 00000

Capital lease obligations(1) ..................... 31,464 18,638 11,573 1,253 0

Operating lease obligations(1) ................... 55,809 7,468 13,141 9,243 25,957

Purchase obligations(1) ......................... 9,709 9,709 0 0 0

Asset retirement obligations .................... 7,3050007,305

Liability for uncertain tax positions .............. 1,821 0 71 91 1,659

DVD agreement obligations(1) ................... 1,446,166 454,030 699,900 292,236 0

Retailer revenue share obligations(1) .............. 125,083 45,200 70,518 9,365 0

Interest rate swaps ............................ 896 896 0 0 0

Total .................................. $2,039,914 $744,191 $948,611 $312,191 $34,921

(1) See Note 9: Commitments and Contingencies in our Notes to Consolidated Financial Statements.

OFF-BALANCE SHEET ARRANGEMENTS

We do not have any off-balance sheet arrangements, that have or are reasonably likely to have a material current

or future effect on our financial condition, changes in financial condition, revenues or expenses, results of

operations, liquidity, capital expenditures or capital resources.

For additional information see Note 9: Commitments and Contingencies in the Notes to Consolidated Financial

Statements.

Item 7A. Quantitative and Qualitative Disclosures About Market Risk

Variable Rates of Interest and Interest Rate Swap

We are subject to the risk of fluctuating interest rates in the normal course of business, primarily as a result of our

revolving credit agreement with a syndicate of lenders led by Bank of America, N.A. and investment activities

that generally bear interest at variable rates. Because our investments have maturities of three months or less and

our credit facility interest rates are based upon either the LIBOR, prime rate or base rate plus an applicable

margin, we believe that the risk of material loss is low and that the carrying amount of these balances

approximates fair value.

Based on the balance of our outstanding revolving line of credit of $150.0 million as of December 31, 2010, an

increase or decrease in interest rates over the next year would affect our interest expense after our interest rate

swap arrangement expires on March 20, 2011. Since we entered into an interest rate swap with a notional amount

of $150.0 million in March 2008, we have hedged our interest rate risk. The interest rate swap converts our

variable one-month LIBOR rate financing into a fixed interest rate financing. The fixed interest rate swap

reduces the effect of fluctuations in the market interest rates. After the expiration of our interest rate swap

arrangement, an increase of 1% in the interest rate over the next year would increase our annual interest expense

by approximately $0.7 million, net of tax.

Foreign Exchange Rate Fluctuation

We are subject to the risk of foreign exchange rate fluctuation in the normal course of business as a result of our

operations in Europe, Canada, and Mexico.

42