Redbox 2010 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2010 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

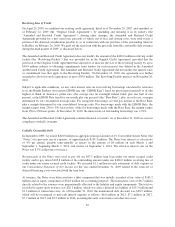

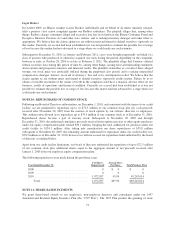

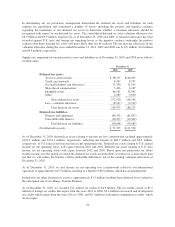

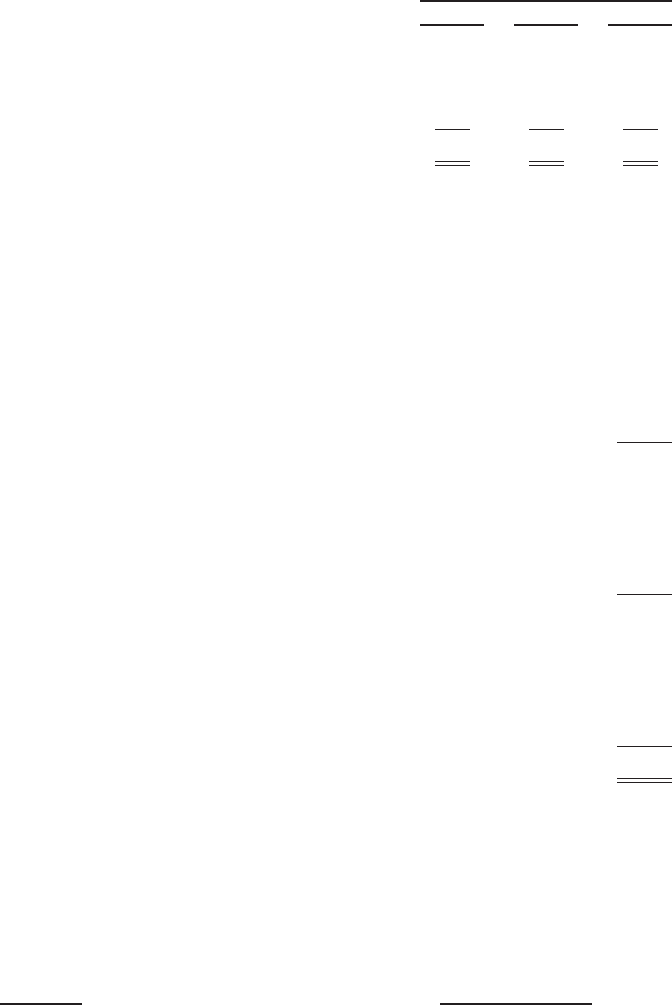

The income tax expense differs from the amount that would result by applying the U.S. statutory rate to income

before income taxes as follows:

Year Ended December 31,

2010 2009 2008

U.S. federal tax expense at statutory rates ............. 35.0% 35.0% 35.0%

State income taxes, net of federal benefit .............. 3.5% 3.8% 2.8%

Non-controlling interest ........................... 0.0% (1.8)% (7.4)%

Other .......................................... 1.0% 0.1% (1.0)%

39.5% 37.1% 29.4%

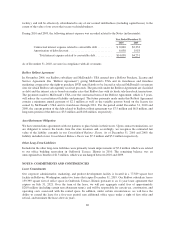

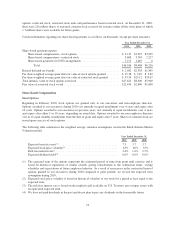

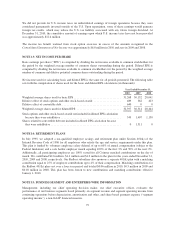

Unrecognized tax benefits of $1.8 million at December 31, 2010 primarily related to R&D credit and income/

expense recognition, all of which would have an effect on our effective tax rate if recognized. A rollforward of

unrecognized tax benefits was as follows (in thousands):

Balance as of January 1, 2008 ......................................... $1,200

Additions based on tax positions related to the current year ............... 0

Additions for tax positions of prior years ............................. 0

Reductions for tax positions of prior years ............................ 0

Reductions as a result of lapse of applicable statute of limitations .......... 0

Settlements ..................................................... 0

Balance as of December 31, 2008 ...................................... 1,200

Additions based on tax positions related to the current year ............... 100

Additions for tax positions of prior years ............................. 500

Reductions for tax positions of prior years ............................ 0

Reductions as a result of lapse of applicable statute of limitations .......... 0

Settlements ..................................................... 0

Balance as of December 31, 2009 ...................................... 1,800

Additions based on tax positions related to the current year ............... 70

Additions for tax positions of prior years ............................. 0

Reductions for tax positions of prior years ............................ (39)

Reductions as a result of lapse of applicable statute of limitations .......... (10)

Settlements ..................................................... 0

Balance as of December 31, 2010 ...................................... $1,821

As of December 31, 2010, it was not necessary to accrue interest and penalties associated with the uncertain tax

positions identified because operating losses and tax credit carryforwards were sufficient to offset all

unrecognized tax benefits.

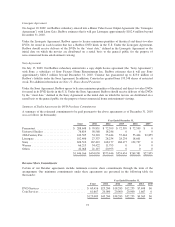

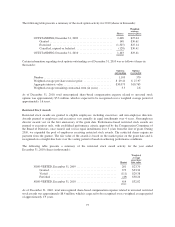

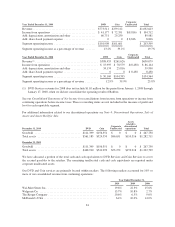

For our major tax jurisdiction, the following years were open for examination by the tax authorities as of

December 31, 2010:

Jurisdiction Open Tax Years

U.S. 2002 through 2009

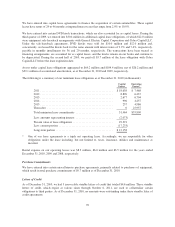

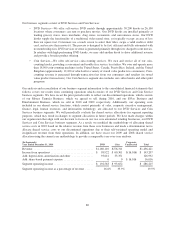

Deferred income tax assets and liabilities reflect the net tax effects of temporary differences between the carrying

amounts of assets and liabilities for financial reporting purposes and the carrying amounts used for income tax

purposes. Future tax benefits for net operating loss and tax credit carryforwards are also recognized to the extent

that realization of such benefits is more likely than not.

77