Redbox 2010 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2010 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

facility), and will be effectively subordinated to any of our secured indebtedness (including capital leases) to the

extent of the value of our assets that secure such indebtedness.

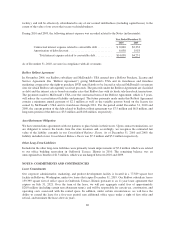

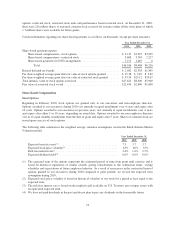

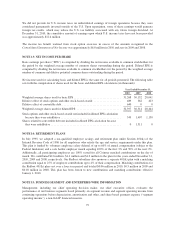

During 2010 and 2009, the following interest expense was recorded related to the Notes (in thousands):

Year Ended December 31,

2010 2009

Contractual interest expense related to convertible debt .......... $ 8,000 $2,333

Amortization of debt discount .............................. 6,038 1,918

Total interest expense related to convertible debt ........... $14,038 $4,251

As of December 31, 2010, we were in compliance with all covenants.

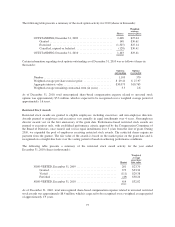

Redbox Rollout Agreement

In November 2006, our Redbox subsidiary and McDonald’s USA entered into a Rollout Purchase, License and

Service Agreement (the “Rollout Agreement”) giving McDonald’s USA and its franchisees and franchise

marketing cooperatives the right to purchase DVD rental kiosks to be located at selected McDonald’s restaurant

sites for which Redbox subsequently received proceeds. The proceeds under the Rollout Agreement are classified

as debt and the interest rate is based on similar rates that Redbox has with its kiosk sale-leaseback transactions.

The payments made to McDonald’s USA over the contractual term of the Rollout Agreement, which is 5 years,

will reduce the accrued interest liability and principal. The future payments made under this Rollout Agreement

contain a minimum annual payment of $2.1 million as well as the variable payouts based on the license fee

earned by McDonald’s USA and its franchisees through 2011. For the period ended December 31, 2010 and

2009, the current portion of the debt related to Redbox rollout agreement was $7.5 million and $6.8 million, and

long-term portion of the debt was $3.3 million and $10.8 million, respectively.

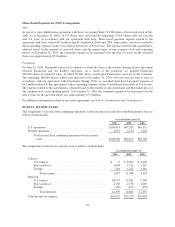

Asset Retirement Obligation

We have entered into agreements with our partners to place kiosks in their stores. Upon contract terminations, we

are obligated to remove the kiosks from the store locations and, accordingly, we recognize the estimated fair

value of the liability currently in our Consolidated Balance Sheets. As of December 31, 2010 and 2009, the

liability included on our Consolidated Balance Sheets was $7.3 million and $5.2 million respectively.

Other Long-Term Liabilities

Included in the other long-term liabilities were primarily tenant improvements of $5.4 million which were related

to our office building renovation in Oakbrook Terrace, Illinois in 2010. The remaining balance was an

unrecognized tax benefit of $1.3 million, which was unchanged between 2010 and 2009.

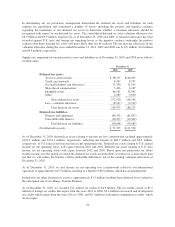

NOTE 9: COMMITMENTS AND CONTINGENCIES

Lease Commitments

Our corporate administrative, marketing, and product development facility is located in a 77,589 square foot

facility in Bellevue, Washington, under two leases that expire December 31, 2019. Our Redbox subsidiary leases

159,399 square feet of office space in Oakbrook Terrace, Illinois pursuant to an 11-year lease agreement that

expires on July 31, 2021. Over the term of the lease, we will pay aggregate rental fees of approximately

$28.0 million (including certain rent abatement terms), and will be responsible for certain tax, construction, and

operating costs associated with the rented space. In addition, under certain circumstances, we will have the

ability to extend the lease for a five-year period, rent additional office space under a right of first offer and

refusal, and terminate the lease after six years.

69