Redbox 2010 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2010 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

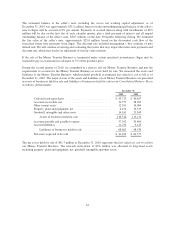

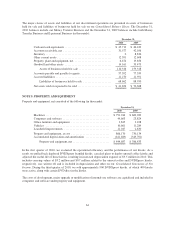

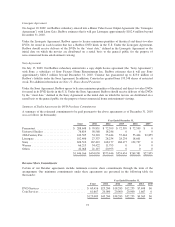

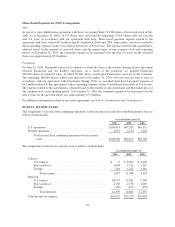

Expected amortization is as follows over the next five years and thereafter (in thousands):

Retailer

Relationships Other

2011 ................................................... $2,457 $283

2012 ................................................... 2,457 81

2013 ................................................... 2,250 14

2014 ................................................... 1,432 14

2015 ................................................... 12 14

Thereafter ............................................... 130 428

Total expected amortization ............................. $8,738 $834

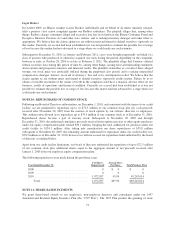

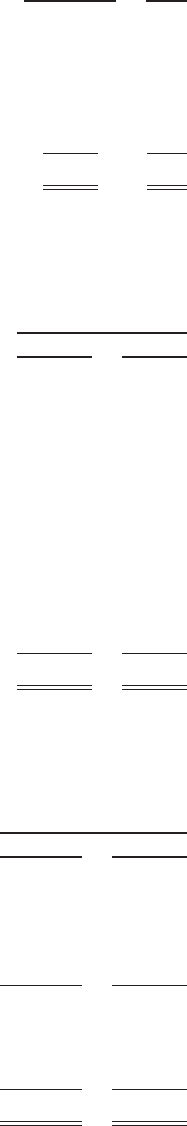

NOTE 7: ACCRUED LIABILITIES

Accrued liabilities consisted of the following (in thousands):

December 31,

2010 2009

Accrued payroll related expenses ............................ $ 29,931 $19,996

Accrued procurement cost for DVD library .................... 21,801 6,704

Accrued property/business taxes ............................. 8,712 5,105

Accrued sales, use, and franchise taxes ....................... 7,627 7,665

Accrued interest expenses .................................. 5,901 4,954

Accrued service contract provider expenses .................... 5,365 5,787

Accrued insurance ........................................ 5,172 3,432

Deferred rent expenses .................................... 4,399 739

Income tax payable ....................................... 2,262 2,880

Accrued professional fees .................................. 2,176 3,654

Accrued litigation settlement ............................... 0 3,500

Others ................................................. 15,076 15,608

$108,422 $80,024

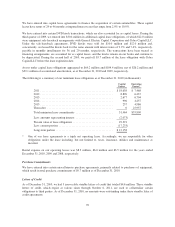

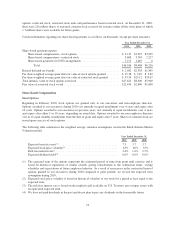

NOTE 8: DEBT AND OTHER LONG-TERM LIABILITIES

Debt consisted of the following (in thousands):

December 31,

2010 2009

Revolving line of credit (matures November 2012) ............ $150,000 $225,000

Callable convertible debt ................................. 173,146 167,109

Redbox rollout agreement ................................ 10,791 17,618

Asset retirement obligation ............................... 7,305 5,217

Other long-term liabilities ................................ 6,688 1,255

347,930 416,199

Less:

Current portion of callable convertible debt .............. (173,146) 0

Current portion of Redbox rollout agreement ............. (7,523) (6,812)

Long-term Debt and Other ........................ $167,261 $409,387

66