Redbox 2010 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2010 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Our money transfer service is, and will remain, reliant on an effective agent network.

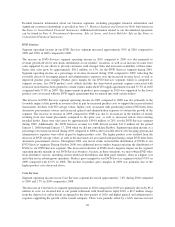

Substantially all of the Money Transfer Services revenue is generated through an agent network spanning

approximately 136 countries as of December 31, 2010. Agents include banks and other financial institutions,

regional micro-finance companies, chain stores and local convenience stores. Transaction volumes at existing

agent locations often increase over time and new agents provide us with additional revenue. If agents decide to

leave our network, or if we are unable to sign new agents, our revenue and profit growth rates may be adversely

affected. Agent attrition might occur for a number of reasons, including a competitor engaging an agent or an

agent’s dissatisfaction with its relationship with us or the revenue derived from that relationship. In addition,

agents may generate fewer transactions or less revenue for various reasons, including changes in economic

circumstances affecting consumers and potential consumers, the appearance of competitors close to our agent

locations or increased competition. Because an agent is a third party that engages in a variety of activities in

addition to providing our services, an agent may encounter business difficulties unrelated to its provision of our

services, which could cause the agent to reduce its number of locations, hours of operation, or cease doing

business altogether. Moreover, we could suffer financial loss and additional liability from the failure, for any

reason, of our agents to provide good funds in a money transfer. The failure of the agent network to meet our

expectations regarding revenue production and business efficiencies may negatively impact our business,

financial condition and results of operations.

Further, failure, either intentional or unintentional, by our agents to comply with the laws and regulatory

requirements of applicable jurisdictions, including anti-money laundering, consumer privacy and information

security restrictions, in connection with our Money Transfer Business or otherwise, could result in, among other

things, revocation of required licenses or registrations, loss of approved status, termination of contracts with third

parties, administrative enforcement actions and fines, seizure or forfeiture of our funds, class action lawsuits,

cease and desist orders and civil and criminal liability, as well as damage to our reputation. The occurrence of

one or more of these events could materially adversely affect our business, financial condition and results of

operations.

Acquisitions and investments involve risks that could harm our business and impair our ability to realize

potential benefits from such acquisitions and investments.

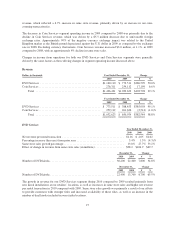

As part of our business strategy, we have in the past sought, and may in the future seek, to acquire or invest in

businesses, products or technologies that we feel could complement or expand our business. For example, in

2006 and 2008 we completed the acquisitions of the entities that comprise our Money Transfer Business.

However, we may be unable to adequately address the financial, legal and operational risks raised by such

acquisitions or investments and may not successfully integrate these acquisitions or investments, which could

harm our business and prevent us from realizing the projected benefits of the acquisitions and investments.

Further, the evaluation and negotiation of potential acquisitions and investments, as well as the integration of

acquired businesses, divert management time and other resources. In addition, we cannot assure you that any

particular transaction, even if successfully completed, will ultimately benefit our business. Certain financial and

operational risks related to acquisitions and investments that may have a material impact on our business are:

• the assumption of known and unknown liabilities of an acquired company, including employee and

intellectual property claims and other violations of applicable law;

• losses related to acquisitions and investments;

• managing relationships with other investors and the companies in which we have made investments;

• reduced liquidity, including through the use of cash resources and incurrence of debt and contingent

liabilities in funding acquisitions and investments;

• difficulties and expenses in assimilating the operations, products, technology, information systems or

personnel of an acquired company;

• inability to efficiently divest unsuccessful acquisitions and investments;

17