Redbox 2010 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2010 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Legal Matters

In October 2009, an Illinois resident, Laurie Piechur, individually and on behalf of all others similarly situated,

filed a putative class action complaint against our Redbox subsidiary. The plaintiff alleges that, among other

things, Redbox charges consumers illegal and excessive late fees in violation of the Illinois Consumer Fraud and

Deceptive Business Practices Act and other state statutes, and is seeking monetary damages and other relief as

appropriate. We believe that the claims against us are without merit and intend to defend ourselves vigorously in

this matter. Currently, no accrual had been established as it was not possible to estimate the possible loss or range

of loss because this matter had not advanced to a stage where we could make any such estimate.

Subsequent to December 31, 2010, in January and February 2011, cases were brought purportedly on behalf of a

class of persons who purchased or otherwise acquired our stock during the period, depending on the complaint,

between as early as October 28, 2010 to as late as February 3, 2011. The plaintiffs allege that Coinstar violated

federal securities laws during this period of time by, among other things, issuing false and misleading statements

about current and prospective business and financial results. The plaintiffs claim that, as a result of these alleged

wrongs, our stock price was artificially inflated during the purported class period, and is seeking unspecified

compensatory damages, interest, an award of attorneys’ fees and costs, and injunctive relief. We believe that the

claims against us are without merit and intend to defend ourselves vigorously in this matter. Failure by us to

obtain a favorable resolution of the claims set forth in the complaint could have a material adverse effect on our

business, results of operations and financial condition. Currently, no accrual had been established as it was not

possible to estimate the possible loss or range of loss because this matter had not advanced to a stage where we

could make any such estimate.

NOTE 10: REPURCHASES OF COMMON STOCK

Following our Board of Directors authorization, on December 1, 2010, and consistent with the terms of our credit

facility, we are permitted to repurchase up to (i) $72.5 million of our common stock plus (ii) cash proceeds

received after November 20, 2007 from the exercise of stock options by our officers, directors or employees.

This authorization allowed us to repurchase up to $74.5 million of our common stock as of December 31, 2010.

Repurchased shares become a part of treasury stock. Subsequent to November 20, 2007 and through

December 31, 2010, the authorized cumulative proceeds received from option exercises or other equity purchases

under our equity compensation plans totaled $59.1 million, bringing the total authorized for purchase under our

credit facility to $134.1 million. After taking into consideration our share repurchases of $55.8 million

subsequent to November 20, 2007, the remaining amount authorized for repurchase under our credit facility was

$78.3 million as of December 31, 2010, however we will not exceed our repurchase limit authorized by the board

of directors as outlined below.

Apart from our credit facility limitations, our board of directors authorized the repurchase of up to $72.5 million

of our common stock plus additional shares equal to the aggregate amount of net proceeds received after

January 1, 2003 from our employee equity compensation plans.

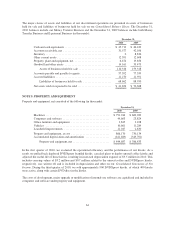

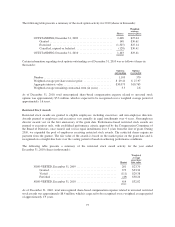

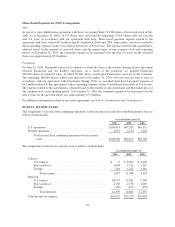

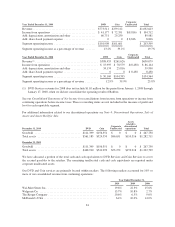

The following repurchases were made during the past three years:

Year Ended December 31,

# of Shares

Repurchased

Average Price

Per Share Total Purchase Price

2008 ..................................... 0 $ 0 $ 0

2009 ..................................... 0 0 0

2010 ..................................... 1,072,037 45.94 49,245,014

Total ................................. 1,072,037 $45.94 $49,245,014

NOTE 11: SHARE-BASED PAYMENTS

We grant share-based awards to our employees, non-employee directors and consultants under our 1997

Amended and Restated Equity Incentive Plan (the “1997 Plan”). The 1997 Plan permits the granting of stock

73