Redbox 2010 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2010 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

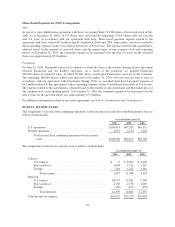

Share-Based Payments for DVD Arrangements

Sony

As part of a copy depth license agreement with Sony, we granted Sony 193,348 shares of restricted stock in July

2009. As of December 31, 2010, 19,335 shares were vested and the remaining 174,013 shares will vest over the

next 3.6 years in accordance with our agreement with Sony. Share-based payment expense related to the

agreement with Sony totaled $4.0 million and $1.4 million in 2010 and 2009, respectively, and was recorded to

direct operating expenses in the Consolidated Statements of Net Income. The expense related to this agreement is

adjusted based on the number of unvested shares and the market price of our common stock each reporting

period. At December 31, 2010, the estimated expense to be amortized over the next 3.6 years for the unvested

shares was approximately $5.0 million.

Paramount

On June 15, 2010, Paramount exercised its option to extend the term of the revenue sharing license agreement

between Paramount and our Redbox subsidiary. As a result of the extension, we granted Paramount

200,000 shares of restricted stock, of which 20,000 shares vested upon Paramount’s exercise of the extension.

The remaining 180,000 shares, which were unvested at December 31, 2010, will vest over the next 4 years in

accordance with our agreement with Paramount. During 2010, we recorded share-based payment expense of

$3.3 million related to this agreement to direct operating expenses in the Consolidated Statements of Net Income.

The expense related to this agreement is adjusted based on the number of unvested shares and the market price of

our common stock each reporting period. At December 31, 2010, the estimated expense to be amortized over the

next 4 years for the unvested shares was approximately $7.9 million.

For additional information related to our studio agreements see Note 9: Commitments and Contingencies.

NOTE 12: INCOME TAXES

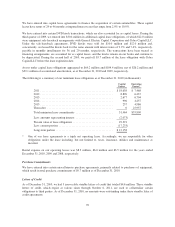

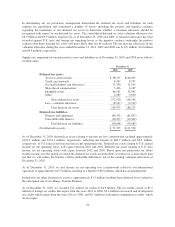

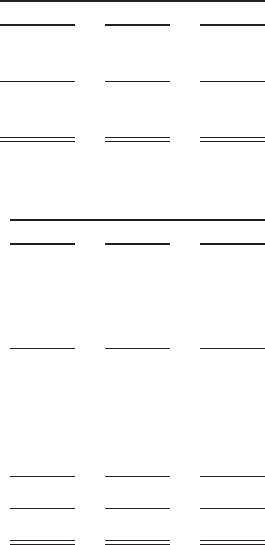

The components of income from continuing operations before income taxes and non-controlling interest were as

follows (in thousands):

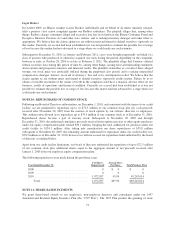

Year Ended December 31,

2010 2009 2008

U.S. operations ......................................... $106,653 $67,283 $61,531

Foreign operations ...................................... 2,273 2,130 3,234

Total income from continuing operations before income

taxes ........................................... $108,926 $69,413 $64,765

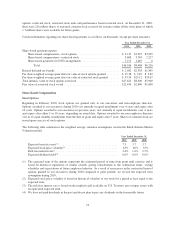

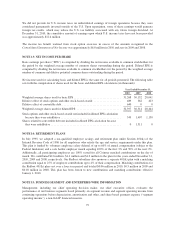

The components of income tax expense were as follows (in thousands):

Year Ended December 31,

2010 2009 2008

Current:

U.S. federal ......................................... $ 0 $ 8,305 $ 4,602

State and local ...................................... 1,003 1,511 1,520

Foreign ............................................ 634 1,222 1,381

Total current .................................... 1,637 11,038 7,503

Deferred:

U.S. federal ......................................... 36,957 12,581 9,746

State and local ...................................... 4,703 2,738 2,265

Foreign ............................................ (265) (637) (476)

Total deferred ................................... 41,395 14,682 11,535

Total income tax expense .................................. $43,032 $25,720 $19,038

76