Redbox 2010 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2010 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

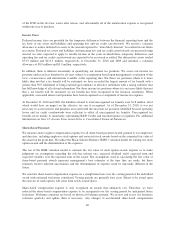

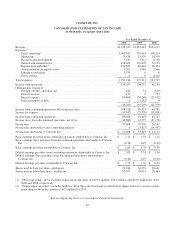

COINSTAR, INC.

CONSOLIDATED STATEMENTS OF EQUITY

AND COMPREHENSIVE INCOME (LOSS)

(in thousands, except share data)

Common Stock

Retained

Earnings

(Accumulated

Deficit)

Treasury

Stock

Accumulated

Other

Comprehensive

Loss

Non-

Controlling

Interest Total

Comprehensive

Income (Loss)Shares Amount

BALANCE at December 31, 2007 ........... 27,739,044 $354,509 $ (16,784) $(40,831) $ 8,236 $ 0 $305,130

Proceeds from exercise of stock options,

net ............................... 425,410 8,629 0 0 0 0 8,629

Share-based payments .................. 90,616 6,597 0 0 0 0 6,597

Increased ownership percentage of

Redbox ........................... 0 0 0 0 0 31,060 31,060

Net income .......................... 0 0 14,112 0 0 0 14,112 $14,112

Loss on short-term investments, net of

tax benefit of $27 ............... 0 0 0 0 (41) 0 (41) (41)

Foreign currency translation

adjustments, net of tax benefit of

$544.......................... 0 0 0 0 (9,845) 0 (9,845) (9,845)

Interest rate hedges on long-term debt,

net of tax benefit of $2,912 ........ 0 0 0 0 (4,554) 0 (4,554) (4,554)

Total comprehensive loss ............... 0 0 0 0 0 0 0 $ (328)

BALANCE at December 31, 2008 ........... 28,255,070 369,735 (2,672) (40,831) (6,204) 31,060 351,088

Proceeds from exercise of stock options,

net ............................... 748,601 16,014 0 0 0 0 16,014

Share-based payments .................. 325,211 8,732 0 0 0 349 9,081

Convertible debt—equity portion, net of

tax ............................... 0 20,391 0 0 0 0 20,391

Tax deficiency on share-based payments . . . 0 (729) 0 0 0 0 (729)

Purchase of non-controlling interest in

Redbox, net of $56,226 deferred tax

benefit ............................ 0 (56,303) 0 0 0 (35,036) (91,339)

Share issuance for purchase of Redbox

non-controlling interest ............... 1,747,902 48,493 0 0 0 0 48,493

Net income .......................... 0 0 53,643 0 0 3,627 57,270 $57,270

Gain on short-term investments, net of

tax expense of $10 .............. 0 0 0 0 15 0 15 15

Foreign currency translation

adjustments, net of tax expense of

$394.......................... 0 0 0 0 831 0 831 831

Interest rate hedges on long-term debt,

net of tax expense of $816 ........ 0 0 0 0 1,276 0 1,276 1,276

Comprehensive income ................. 0 0 0 0 0 0 0 $59,392

Less: Comprehensive income attributable to

non-controlling interests .............. 0 0 0 0 0 0 0 (3,627)

Total comprehensive income ............ 0 0 0 0 0 0 0 $55,765

BALANCE at December 31, 2009 ........... 31,076,784 406,333 50,971 (40,831) (4,082) 0 412,391

Proceeds from exercise of stock options,

net ............................... 1,324,756 31,686 0 0 0 0 31,686

Share-based payments .................. 485,582 16,234 0 0 0 0 16,234

Tax benefit on share-based payments ...... 0 6,770 0 0 0 0 6,770

Shares repurchased .................... (1,072,037) 0 0 (49,245) 0 0 (49,245)

Debt conversion feature ................ 0 (26,854) 0 0 0 0 (26,854)

Net income .......................... 0 0 51,008 0 0 0 51,008 $51,008

Gain on short-term investments, net of

tax expense of $4 ............... 0 0 0 0 6 0 6 6

Foreign currency translation

adjustments, net of tax benefit of

$132.......................... 0 0 0 0 (1,605) 0 (1,605) (1,605)

Interest rate hedges on long-term debt,

net of tax expense of $1,746 ....... 0 0 0 0 2,731 0 2,731 2,731

Total comprehensive income ............ 0 0 0 0 0 0 0 $52,140

BALANCE at December 31, 2010 ........... 31,815,085 $434,169 $101,979 $(90,076) $(2,950) $ 0 $443,122

See accompanying Notes to Consolidated Financial Statements.

50