Redbox 2010 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2010 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Income Taxes

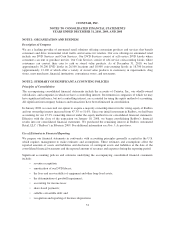

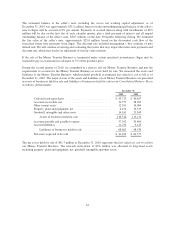

Deferred income taxes are provided for the temporary differences between the financial reporting basis and the

tax basis of our assets and liabilities and operating loss and tax credit carryforwards. We record a valuation

allowance to reduce deferred tax assets to the amount expected to “more likely than not” be realized in our future

tax returns. Deferred tax assets and liabilities and operating loss and tax credit carryforwards are measured using

enacted tax rates expected to apply to taxable income in the years in which those temporary differences and

operating loss and tax credit carryforwards are expected to be recovered or settled. Net deferred tax assets totaled

$73.3 million and $111.5 million, respectively, at December 31, 2010 and 2009 and included a valuation

allowance of $8.9 million and $9.9 million, respectively.

In addition, there is inherent uncertainty in quantifying our income tax positions. We assess our income tax

positions and record tax benefits for all years subject to examination based upon management’s evaluation of the

facts, circumstances and information available at the reporting date. For those tax positions where it is more

likely than not that a tax benefit will be sustained, we have recorded the largest amount of tax benefit with a

greater than 50% likelihood of being realized upon ultimate or effective settlement with a taxing authority that

has full knowledge of all relevant information. For those income tax positions where it is not more likely than not

that a tax benefit will be sustained, no tax benefit has been recognized in the financial statements. When

applicable, associated interest and penalties have been recognized as a component of income tax expense.

At December 31, 2010 and 2009, the liabilities related to total unrecognized tax benefits were $1.8 million, all of

which would have an impact on the effective tax rate if recognized. As of December 31, 2010, it was not

necessary to accrue for interest and penalties associated with the unrecognized tax benefits identified because the

operating losses and tax credit carryforwards were sufficient to offset all unrecognized tax benefits.

Unrecognized tax benefits relate primarily to uncertainty surrounding R&D credit and income/expense

recognition. For additional information see Note 12: Income Taxes.

Taxes Collected from Customers and Remitted to Governmental Authorities

We account for tax assessed by a governmental authority that is directly imposed on a revenue-producing

transaction (i.e., sales, use, value added) on a net (excluded from revenue) basis.

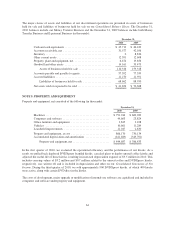

Research and Development

Costs incurred for research and development activities are expensed as incurred.

Advertising

Advertising costs, which are included as a component of marketing expense, are expensed as incurred and totaled

$15.4 million, $10.8 million and $10.5 million in 2010, 2009 and 2008, respectively.

Callable Convertible Debt

In September 2009, we issued $200 million aggregate principal amount of 4% Convertible Senior Notes (the

“Notes”). We have separately accounted for the liability and the equity components of the Notes based on the

estimated fair value of the debt upon issuance.As one of the conversion events was met on December 31, 2010,

the Notes became convertible in and for the first quarter of 2011 and are reported within the current liability

section in our Consolidated Balance Sheets. The related debt conversion feature was recorded as such in our

Consolidated Balance Sheets. For additional information see Note 8: Debt.

58