Redbox 2010 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2010 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

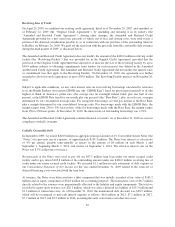

Electronic Payment Business

On May 25, 2010, we sold our subsidiaries comprising our E-Pay Business to InComm Holdings, Inc. and

InComm Europe Limited (collectively “InComm”) for an aggregate purchase price of $40.0 million. The

purchase price was subject to a post-closing net working capital adjustment in the amount of $0.5 million, which

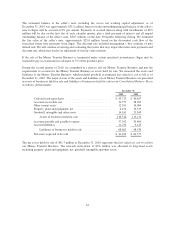

was finalized in October 2010. The disposed assets and liabilities primarily consisted of the following (in

thousands):

May 25,

2010

December 31,

2009

Current assets .......................................... $24,862 $31,236

Property, plant and equipment, net ......................... 2,574 3,343

Goodwill ............................................. 9,039 9,039

Intangible assets ........................................ 61 154

Other assets ........................................... 2,538 2,435

39,074 46,207

Current liabilities ....................................... 27,717 40,416

Net assets sold ......................................... $11,357 $ 5,791

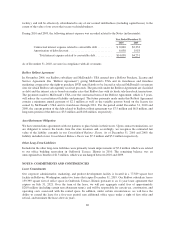

Entertainment Business

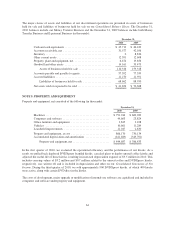

On September 8, 2009, we sold our subsidiaries comprising our Entertainment Business to National

Entertainment Network, Inc. (“National”) for nominal consideration. With the transaction, National assumed the

operations of the Entertainment Business, including substantially all of the Entertainment Business’s related

assets and liabilities. The disposed assets and liabilities primarily consisted of the following (in thousands):

September 8,

2009

Current assets ................................................... $29,378

Property, plant and equipment, net ................................... 35,233

Intangible assets ................................................. 4,410

Other assets ..................................................... 3,062

72,083

Total liabilities ................................................... 25,596

Net assets sold ................................................... $46,487

As a result of the sale, we recorded a pre-tax loss on disposal of $49.8 million and a one-time tax benefit of $82.2

million during the third quarter of 2009.

62