Redbox 2010 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2010 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

We have entered into capital lease agreements to finance the acquisition of certain automobiles. These capital

leases have terms of 24 to 96 months at imputed interest rates that range from 2.0% to 10.0%.

We have entered into certain DVD kiosk transactions, which are also accounted for as capital leases. During the

third quarter of 2009, we entered into $30.4 million in additional capital lease obligations, of which $22.0 million

were equipment sale-leaseback arrangements with General Electric Capital Corporation and Cobra Capital LLC.

Under the sale-leaseback agreements, DVD kiosks were sold for $10.0 million and $12.0 million and,

concurrently, we leased the kiosks back for the same amount with interest rates of 9.2% and 7.4%, respectively,

payable in monthly installments for 36 and 20 months, respectively. The transactions have been treated as

financing arrangements, are accounted for as capital leases, and the kiosks remain on our books and continue to

be depreciated. During the second half of 2010, we paid off $5.7 million of the lease obligation with Cobra

Capital LLC before the lease expiration date.

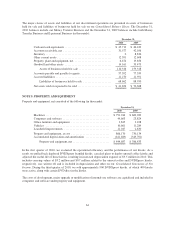

Assets under capital lease obligations aggregated to $69.2 million and $104.4 million, net of $26.2 million and

$39.1 million of accumulated amortization, as of December 31, 2010 and 2009, respectively.

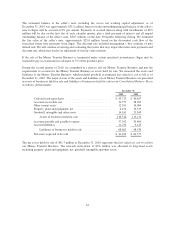

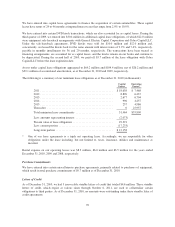

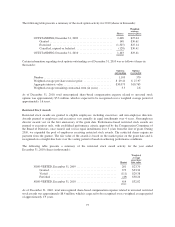

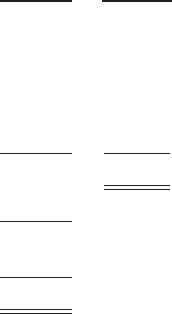

The following is a summary of our minimum lease obligations as of December 31, 2010 (in thousands):

Capital

Leases

Operating

Leases*

2011 ................................................... $18,638 $ 7,468

2012 ................................................... 8,896 6,437

2013 ................................................... 2,677 6,704

2014 ................................................... 996 4,257

2015 ................................................... 257 4,986

Thereafter .............................................. 0 25,957

Total minimum lease commitments .......................... 31,464 $55,809

Less: amounts representing interest .......................... (2,073)

Present value of lease obligations ............................ 29,391

Less: current portion ...................................... (17,233)

Long-term portion ........................................ $12,158

* One of our lease agreements is a triple net operating lease. Accordingly, we are responsible for other

obligations under the lease including, but not limited to, taxes, insurance, utilities and maintenance as

incurred.

Rental expense on our operating leases was $8.3 million, $6.0 million and $3.5 million for the years ended

December 31, 2010, 2009 and 2008, respectively.

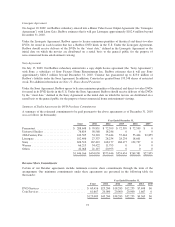

Purchase Commitments

We have entered into certain miscellaneous purchase agreements, primarily related to purchases of equipment,

which result in total purchase commitments of $9.7 million as of December 31, 2010.

Letters of Credit

As of December 31, 2010, we had 3 irrevocable standby letters of credit that totaled $4.6 million. These standby

letters of credit, which expire at various times through October 6, 2011, are used to collateralize certain

obligations to third parties. As of December 31, 2010, no amounts were outstanding under these standby letter of

credit agreements.

70