Redbox 2010 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2010 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.CRITICAL ACCOUNTING POLICIES AND USE OF ESTIMATES

We prepare our financial statements in conformity with GAAP which requires management to make estimates

and assumptions. These estimates and assumptions affect the reported amounts of assets and liabilities and

disclosure of contingent assets and liabilities at the date of the consolidated financial statements and the reported

amount of revenues and expenses during the reporting period.

Significant accounting policies and estimates underlying the accompanying consolidated financial statements

include:

• revenue recognition;

• the lives and recoverability of equipment and other long-lived assets;

• the determination of goodwill impairment;

• amortization of our DVD library;

• accounting for income taxes;

• share-based payments;

• callable convertible debt; and

• recognition and reporting of business dispositions

It is reasonably possible that the estimates we make may change in the future.

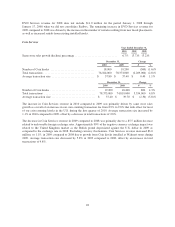

Revenue Recognition

We recognize revenue as follows:

• DVD Services—Revenue from movie DVD rentals is recognized ratably over the term of a consumer’s

rental transaction. Revenue from a direct sale out of the kiosk of previously rented movies is

recognized at the time of sale. On rental transactions for which the related movies have not yet been

returned to the kiosk at month-end, revenue is recognized with a corresponding receivable recorded in

the balance sheet, net of a reserve for potentially uncollectible amounts. We record revenue, net of

refunds and applicable sales taxes collected from consumers.

• Coins Services—Coin-counting revenue, which is collected from either consumers or card issuers (in

stored value product transactions), is recognized at the time the consumers’ coins are counted by our

coin-counting kiosks. Cash deposited in kiosks that has not yet been collected is referred to as cash in

machine and is reported in our Consolidated Balance Sheets with cash in machine or in transit. Our

revenue represents the fee charged for coin-counting transactions.

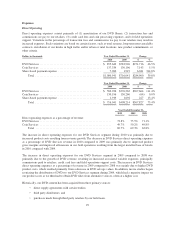

Lives and Recoverability of Equipment and Other Long-Lived Assets

We evaluate the estimated remaining life and recoverability of equipment and other assets, including intangible

assets subject to amortization, whenever events or changes in circumstances indicate that the carrying amount of

the asset may not be recoverable. Factors that would indicate potential impairment include, but are not limited to,

significant decreases in the market value of the long-lived asset(s), a significant change in the long-lived asset’s

physical condition and operating or cash flow losses associated with the use of the long-lived asset. When there

is an indication of impairment, we prepare an estimate of future, undiscounted cash flows expected to result from

the use of the asset and its eventual disposition to test the recoverability. If the sum of the future undiscounted

cash flow is less than the carrying value of the asset, it indicates that the long-lived assets are not recoverable, in

which case we will then compare the estimated fair value to its carrying value. If the estimated fair value is less

than the carrying value of the asset, we recognize the impairment loss and adjust the carrying amount of the asset

to its estimated fair value.

38