Redbox 2010 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2010 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Our business segments consist of DVD Services and Coin Services:

• DVD Services—We offer self-service DVD rentals through approximately 30,200 kiosks in 26,100

locations where consumers can rent or purchase movies. Our DVD kiosks are installed primarily at

leading grocery stores, mass merchants, drug stores, restaurants, and convenience stores. Our DVD

kiosks supply the functionality of a traditional video rental store, yet typically occupy an area of less

than ten square feet. Consumers use a touch screen to select their titles, swipe a valid credit or debit

card, and receive their movie(s). The process is designed to be fast, efficient and fully automated with

no membership fees. DVD services revenue is generated primarily through fees charged to rent movies.

In retailers with high performing DVD kiosks, we may add another kiosk to drive additional revenue

and provide a broader product offering.

• Coin Services—We offer self-service coin-counting services. We own and service all of our coin-

counting kiosks, providing a convenient and trouble-free service to retailers. We own and operate more

than 18,900 coin-counting machines in the United States, Canada, Puerto Rico, Ireland, and the United

Kingdom (approximately 12,100 of which offer a variety of stored value products to consumers). Coin-

counting revenue is generated through transaction fees from our consumers and retailers (in stored

value product transactions). Our Coin Services segment also includes our coffee kiosks and other pilot

programs.

Our analysis and reconciliation of our business segment information to the consolidated financial statements that

follows covers our results from continuing operations which consists of our DVD Services and Coin Service

business segments. We have recast the prior period results to reflect our discontinued operations, which consists

of our Money Transfer Business, which we agreed to sell during 2010, and our E-Pay Business and

Entertainment Business, which we sold in 2010 and 2009, respectively. Additionally, our operating costs

included in our shared service functions, which consist primarily of sales, corporate executive management,

finance, legal, human resources, and information technology, are allocated to our DVD Services and Coin

Services business segments. We will periodically evaluate the shared service allocations for segment reporting

purposes, which may result in changes to segment allocations in future periods. We have made changes within

our organization that align with our decision to focus on our two core automated retailing businesses, our DVD

Services and Coin Services business segments. As a result, we modified the methodology of allocating shared

service costs in 2010 based on the relative revenue from these core businesses and made a determination not to

allocate shared service costs to our discontinued operations due to their self-sustained operating model and

insignificant revenue from their operations. In addition, we have recast our 2009 and 2008 shared service

allocation using the current year methodology to provide a comparable year-over-year analysis.

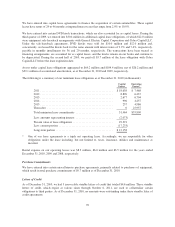

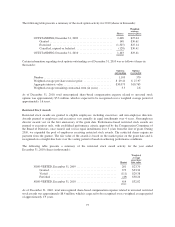

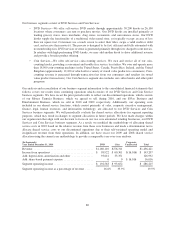

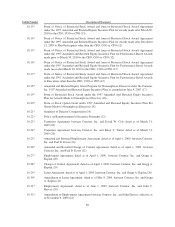

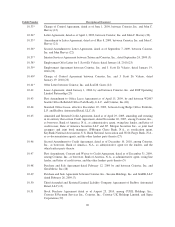

(In thousands)

Year Ended December 31, 2010 DVD Coin

Corporate

Unallocated Total

Revenue .......................................... $1,160,110 $276,311 $1,436,421

Income from operations .............................. $ 98,922 $ 60,301 $(16,016) $ 143,207

Add: depreciation, amortization and other ............... 93,641 33,351 126,992

Add: share-based payment expense ..................... 0 0 $16,016 16,016

Segment operating income ............................ $ 192,563 $ 93,652 $ 286,215

Segment operating income as a percentage of revenue ...... 16.6% 33.9% 19.9%

80