Oracle 2012 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2012 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

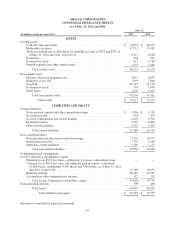

ORACLE CORPORATION

CONSOLIDATED STATEMENTS OF CASH FLOWS

For the Years Ended May 31, 2012, 2011 and 2010

Year Ended May 31,

(in millions) 2012 2011 2010

Cash Flows From Operating Activities:

Net income ........................................................... $ 9,981 $ 8,547 $ 6,135

Adjustments to reconcile net income to net cash provided by operating activities:

Depreciation ...................................................... 486 368 298

Amortization of intangible assets ...................................... 2,430 2,428 1,973

Allowances for doubtful accounts receivable ............................ 92 164 143

Deferred income taxes .............................................. 9 (253) (511)

Stock-based compensation ........................................... 659 510 436

Tax benefits on the exercise of stock options and vesting of restricted stock-

based awards ................................................... 182 325 203

Excess tax benefits on the exercise of stock options and vesting of restricted

stock-based awards ............................................... (97) (215) (110)

Other, net ........................................................ 84 68 13

Changes in operating assets and liabilities, net of effects from acquisitions:

Increase in trade receivables ..................................... (8) (729) (362)

Decrease (increase) in inventories ................................. 150 (28) 73

(Increase) decrease in prepaid expenses and other assets ............... (51) 14 340

Decrease in accounts payable and other liabilities ..................... (720) (120) (360)

Increase (decrease) in income taxes payable ......................... 54 (96) (79)

Increase in deferred revenues ..................................... 492 231 489

Net cash provided by operating activities ....................... 13,743 11,214 8,681

Cash Flows From Investing Activities:

Purchases of marketable securities and other investments....................... (38,625) (31,009) (15,703)

Proceeds from maturities and sales of marketable securities and other investments . . . 35,594 27,120 11,220

Acquisitions, net of cash acquired ......................................... (4,702) (1,847) (5,606)

Capital expenditures .................................................... (648) (450) (230)

Proceeds from sale of property ............................................ — 105 —

Net cash used for investing activities ........................... (8,381) (6,081) (10,319)

Cash Flows From Financing Activities:

Payments for repurchases of common stock ................................. (5,856) (1,160) (992)

Proceeds from issuances of common stock .................................. 733 1,376 874

Payments of dividends to stockholders ..................................... (1,205) (1,061) (1,004)

Proceeds from borrowings, net of issuance costs .............................. 1,700 4,354 7,220

Repayments of borrowings ............................................... (1,405) (3,143) (3,582)

Excess tax benefits on the exercise of stock options and vesting of restricted stock-

based awards ....................................................... 97 215 110

Distributions to noncontrolling interests .................................... (163) (65) (59)

Other, net ............................................................ — — 97

Net cash (used for) provided by financing activities ............... (6,099) 516 2,664

Effect of exchange rate changes on cash and cash equivalents ....................... (471) 600 (107)

Net (decrease) increase in cash and cash equivalents .............................. (1,208) 6,249 919

Cash and cash equivalents at beginning of period ................................. 16,163 9,914 8,995

Cash and cash equivalents at end of period ...................................... $ 14,955 $ 16,163 $ 9,914

Non-cash investing and financing transactions:

Fair value of stock options and restricted stock-based awards assumed in connection

with acquisitions ..................................................... $ 29 $ 17 $ 100

Fair value of contingent consideration payable in connection with acquisition ...... $ 346 $ — $ —

Increase in unsettled repurchases of common stock ........................... $ 112 $ 12 $ —

Supplemental schedule of cash flow data:

Cash paid for income taxes .............................................. $ 2,731 $ 2,931 $ 2,488

Cash paid for interest ................................................... $ 737 $ 770 $ 652

See notes to consolidated financial statements.

87