Oracle 2012 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2012 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Fiscal 2011 Compared to Fiscal 2010: On a constant currency basis, acquisition related and other expenses

increased primarily due to the full fiscal year impact of Sun’s expense contributions, including higher transitional

employee related expenses.

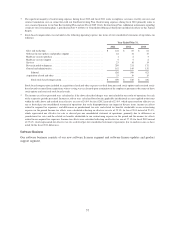

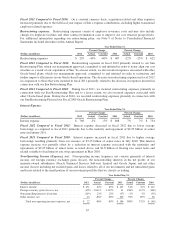

Restructuring expenses: Restructuring expenses consist of employee severance costs and may also include

charges for duplicate facilities and other contract termination costs to improve our cost structure prospectively.

For additional information regarding our restructuring plans, see Note 9 of Notes to Consolidated Financial

Statements included elsewhere in this Annual Report.

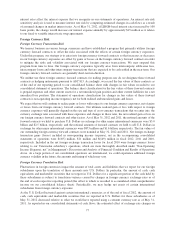

Year Ended May 31,

Percent Change Percent Change

(Dollars in millions) 2012 Actual Constant 2011 Actual Constant 2010

Restructuring expenses ................ $ 295 -40% -40% $ 487 -22% -23% $ 622

Fiscal 2012 Compared to Fiscal 2011: Restructuring expenses in fiscal 2012 primarily related to our Sun

Restructuring Plan, which our management approved, committed to and initiated in order to better align our cost

structure as a result of our acquisition of Sun. To a lesser extent, we also incurred expenses associated with other

Oracle-based plans, which our management approved, committed to and initiated in order to restructure and

further improve efficiencies in our Oracle-based operations. The decrease in restructuring expenses in fiscal 2012

in comparison to those that were incurred in fiscal 2011 primarily related to the decrease in expenses incurred in

connection with our Sun Restructuring Plan.

Fiscal 2011 Compared to Fiscal 2010: During fiscal 2011, we incurred restructuring expenses primarily in

connection with our Sun Restructuring Plan and to a lesser extent, we also incurred expenses associated with

other Oracle-based plans. During fiscal 2010, we recorded restructuring expenses primarily in connection with

our Sun Restructuring Plan and our Fiscal 2009 Oracle Restructuring Plan.

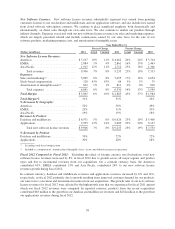

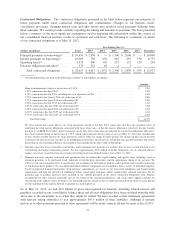

Interest Expense:

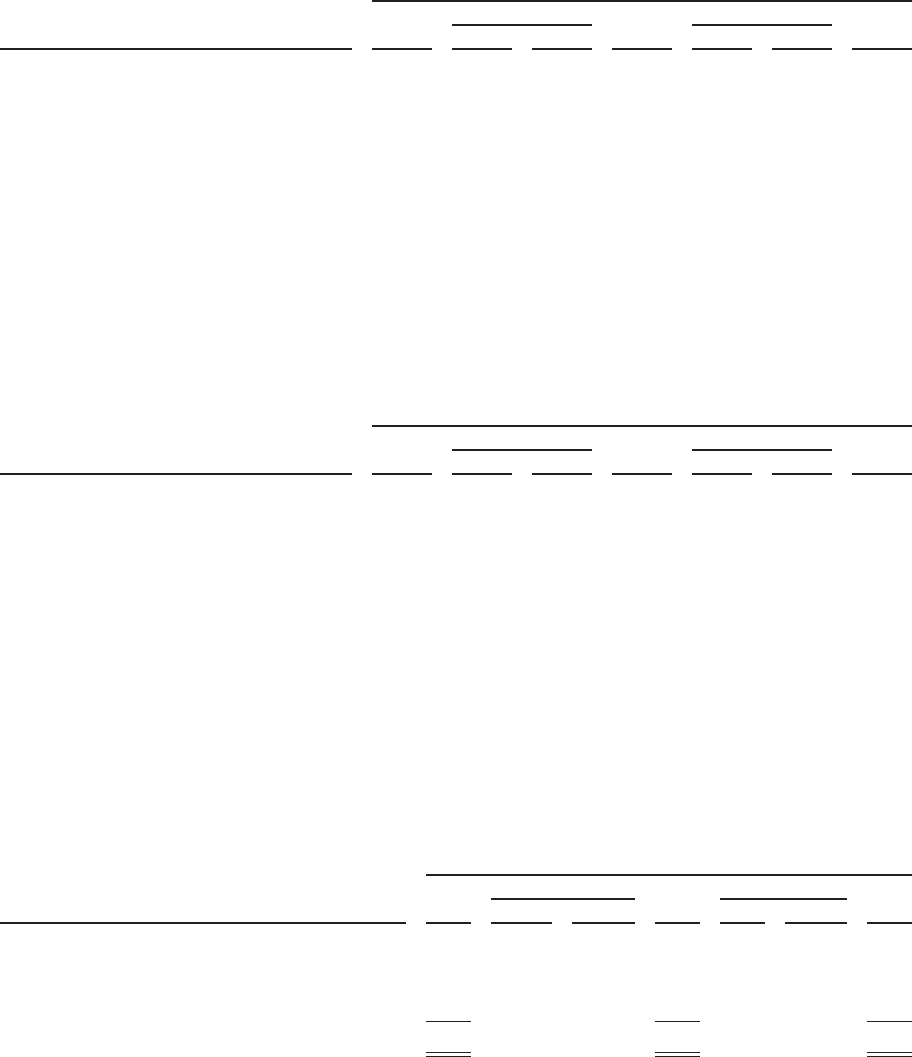

Year Ended May 31,

Percent Change Percent Change

(Dollars in millions) 2012 Actual Constant 2011 Actual Constant 2010

Interest expense ...................... $ 766 -5% -5% $ 808 7% 7% $ 754

Fiscal 2012 Compared to Fiscal 2011: Interest expense decreased in fiscal 2012 due to lower average

borrowings as compared to fiscal 2011 primarily due to the maturity and repayment of $2.25 billion of senior

notes in January 2011.

Fiscal 2011 Compared to Fiscal 2010: Interest expense increased in fiscal 2011 due to higher average

borrowings resulting primarily from our issuance of $3.25 billion of senior notes in July 2010. This interest

expense increase was partially offset by a reduction in interest expense associated with the maturities and

repayments of $2.25 billion of senior notes, as noted above, and $1.0 billion of floating rate senior notes and

related variable to fixed interest rate swap agreements in May 2010.

Non-Operating Income (Expense), net: Non-operating income (expense), net consists primarily of interest

income, net foreign currency exchange gains (losses), the noncontrolling interests in the net profits of our

majority-owned subsidiaries (Oracle Financial Services Software Limited and Oracle Japan) and net other

income (losses) including net realized gains and losses related to all of our investments and net unrealized gains

and losses related to the small portion of our investment portfolio that we classify as trading.

Year Ended May 31,

Percent Change Percent Change

(Dollars in millions) 2012 Actual Constant 2011 Actual Constant 2010

Interest income ................................ $ 231 42% 45% $ 163 34% 32% $ 122

Foreign currency gains (losses), net ................ (105) -1,041% -1,112% 11 108% 112% (148)

Noncontrolling interests in income ................. (119) 23% 25% (97) -2% -1% (95)

Other income, net .............................. 15 -86% -86% 109 92% 89% 56

Total non-operating income (expense), net ....... $ 22 -88% -83% $ 186 388% 372% $ (65)

67