Oracle 2012 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2012 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Excluding the effect of currency rate fluctuations, total software license updates and product support margin and margin

as a percentage of total revenues increased as our total revenues increased while our total expenses remained flat.

Fiscal 2011 Compared to Fiscal 2010: Excluding the effect of currency rate fluctuations, software license

updates and product support revenues increased in fiscal 2011 for similar reasons as those noted above.

In reported currency, software license updates and product support revenues in fiscal 2011 included incremental

revenues of $240 million from Sun through the third quarter of fiscal 2011 (the one year anniversary of our

acquisition) and $80 million from our other recently acquired companies. As described above, the amounts of

software license updates and product support revenues that we recognized in fiscal 2011 and fiscal 2010 were

affected by business combination accounting rules.

On a constant currency basis, total software license updates and product support expenses increased due to an

increase in salaries, variable compensation and benefits expenses that were primarily related to a full year’s

contribution from Sun and certain other headcount increases.

Excluding the effect of currency rate fluctuations, total software license updates and product support margin and margin

as a percentage of total revenues increased as our total revenues increased at a faster rate than our total expenses.

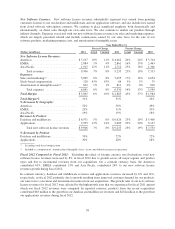

Hardware Systems Business

Our hardware systems business consists of our hardware systems products segment and hardware systems

support segment.

Hardware Systems Products: Hardware systems products revenues are primarily generated from the sales of our

computer server and storage products. We market and sell our hardware systems products through our direct sales

force and indirect channels such as independent distributors and value added resellers. Operating expenses associated

with our hardware systems products include the cost of hardware systems products, which consists of expenses for

materials and labor used to produce these products by our internal manufacturing operations or by third party

manufacturers, warranty expenses and the impact of periodic changes in inventory valuation, including the impact of

inventory determined to be excess and obsolete. Operating expenses associated with our hardware systems products

also include sales and marketing expenses, which are largely personnel related and include variable compensation

earned by our sales force for the sales of our hardware products, and amortization of intangible assets.

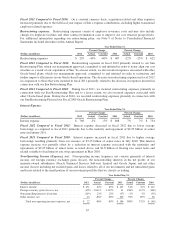

Year Ended May 31,

Percent Change Percent Change

(Dollars in millions) 2012 Actual Constant 2011 Actual Constant 2010

Hardware Systems Products Revenues:

Americas ............................. $ 1,880 -16% -16% $ 2,248 201% 199% $ 747

EMEA ............................... 1,140 -15% -16% 1,337 176% 165% 485

Asia Pacific ........................... 807 1% -3% 797 191% 173% 274

Total revenues ..................... 3,827 -13% -14% 4,382 191% 184% 1,506

Expenses:

Hardware systems products(1) ............. 1,842 -10% -10% 2,055 134% 126% 877

Sales and marketing(1) ................... 1,106 7% 6% 1,037 203% 194% 342

Stock-based compensation ............... 3 -57% -57% 5 4% 4% 5

Amortization of intangible assets(2) ........ 393 -8% -8% 426 164% 164% 162

Total expenses ..................... 3,344 -5% -5% 3,523 154% 146% 1,386

Total Margin ......................... $ 483 -44% -46% $ 859 634% 732% $ 120

Total Margin % ....................... 13% 20% 8%

% Revenues by Geography:

Americas ............................. 49% 51% 50%

EMEA ............................... 30% 31% 32%

Asia Pacific ........................... 21% 18% 18%

(1) Excluding stock-based compensation

(2) Included as a component of ‘Amortization of Intangible Assets’ in our consolidated statements of operations

61