Oracle 2012 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2012 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

with the sale of new software licenses and (3) the amount of support contracts assumed from companies we

have acquired.

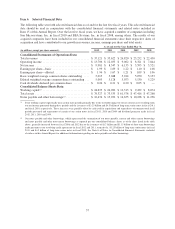

Software license updates and product support revenues, which represented 43%, 42% and 49% of our total

revenues in fiscal 2012, 2011 and 2010, respectively, is our highest margin business unit. The proportion of our

software license updates and product support revenues relative to our total revenues was affected by our entry

into the hardware systems business as a result of our acquisition of Sun in the third quarter of fiscal 2010.

Margins during fiscal 2012 were 87% and accounted for 72% of our total margins over the same period. Our

software license update and product support margins have been affected by fair value adjustments relating to

software support obligations assumed in business combinations (described further below) and by amortization of

intangible assets. However, over the longer term, we believe that software license updates and product support

revenues and margins will grow for the following reasons:

• substantially all of our customers, including customers from acquired companies, renew their support

contracts when eligible for renewal;

• substantially all of our customers purchase software license updates and product support contracts

when they buy new software licenses, resulting in a further increase in our support contract base. Even

if new software license revenues growth was flat, software license updates and product support

revenues would continue to grow in comparison to the corresponding prior year periods assuming

renewal and cancellation rates and foreign currency rates remained relatively constant since

substantially all new software license transactions result in the sale of software license updates and

product support contracts, which add to our support contract base; and

• our acquisitions have increased our support contract base, as well as the portfolio of products available

to be licensed and supported.

We recorded adjustments to reduce support obligations assumed in business combinations to their estimated fair

values at the acquisition dates. As a result, as required by business combination accounting rules, we did not

recognize software license updates and product support revenues related to software support contracts that would

have been otherwise recorded by the acquired businesses as independent entities in the amounts of $48 million,

$80 million and $86 million in fiscal 2012, 2011 and 2010, respectively. To the extent underlying support

contracts are renewed with us following an acquisition, we will recognize the revenues for the full value of the

support contracts over the support periods, the majority of which are one year.

Hardware Systems Business

Our hardware systems business consists of two operating segments: (1) hardware systems products and

(2) hardware systems support. Our hardware business represented 17%, 19% and 9% of our total revenues in

fiscal 2012, 2011 and 2010, respectively. We expect our hardware business to have lower operating margins as a

percentage of revenues than our software business due to the incremental costs we incur to produce and distribute

these products and to provide support services, including direct materials and labor costs. We expect to make

investments in research and development to improve existing hardware products and services and to develop new

hardware products and services.

Hardware Systems Products: We provide a complete selection of hardware systems and related services

including servers, storage, networking, virtualization software, operating systems, and management software to

support diverse IT environments, including public and private cloud computing environments. We engineer our

hardware systems with virtualization and management capabilities to enable the rapid deployment and efficient

management of cloud infrastructures. Our hardware systems products consist primarily of computer server,

storage and hardware-related software, including our Oracle Solaris operating system. Our hardware systems

component products are designed to be “open,” or to work in customer environments that may include other

Oracle or non-Oracle hardware or software components. We have also engineered our hardware systems products

to create performance and operational cost advantages for customers when our hardware and software products

are combined as Oracle Engineered Systems.

40