Oracle 2012 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2012 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Fiscal 2012 Compared to Fiscal 2011: Excluding the effects of currency rate fluctuations, hardware systems

products revenues decreased in fiscal 2012 due to reductions in sales volumes of certain of our legacy product lines,

including lower margin products, and due to the recent introduction of new SPARC processor-based servers that we

believe slowed purchases of predecessor server products. These hardware revenue decreases were partially offset by

increases in hardware revenues attributable to our Oracle Engineered Systems during fiscal 2012.

Excluding the effects of currency rate fluctuations, total hardware systems products operating expenses declined

in fiscal 2012 primarily due to reductions in hardware systems products costs associated with lower revenues,

lower intangible asset amortization, and decreases in bad debt expenses, which were partially offset by increased

employee related expenses due to additional sales headcount.

Excluding the effect of currency rate fluctuations, total hardware systems products margin and total margin as a

percentage of revenues decreased in fiscal 2012 primarily due to decreases in hardware systems products

revenues and increases in hardware sales and marketing expenses.

Fiscal 2011 Compared to Fiscal 2010: The increases in hardware systems products revenues, expenses and

total margin for fiscal 2011 were primarily attributable to the impact of Sun’s contributions to our operating

results for the full fiscal 2011 year as compared to fiscal 2010, which included Sun’s contribution to our

operating results for only a portion of the fiscal year. In fiscal 2010, our hardware systems products expenses and

total margin were unfavorably impacted by $29 million of fair value adjustments made pursuant to business

combination accounting rules for inventories we assumed from Sun and sold to customers in the post-

combination periods. Excluding the effect of currency rate fluctuations, total hardware systems products margin

and margin as a percentage of total revenues increased as our total revenues increased at a faster rate than our

total expenses.

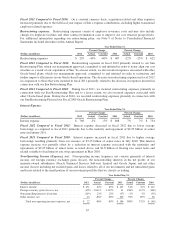

Hardware Systems Support: Our hardware systems support offerings provide customers with software updates

for the software components that are essential to the functionality of our hardware systems and can include

product repairs, maintenance services and technical support services. Expenses associated with our hardware

systems support operating segment include the cost of materials used to repair customer products, the cost of

providing support services, largely personnel related expenses, and the amortization of our intangible assets

associated with hardware systems support contracts and customer relationships obtained from our acquisitions.

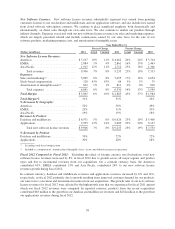

Year Ended May 31,

Percent Change Percent Change

(Dollars in millions) 2012 Actual Constant 2011 Actual Constant 2010

Hardware Systems Support Revenues:

Americas .............................. $ 1,157 5% 5% $ 1,103 267% 263% $ 301

EMEA ................................ 870 -13% -14% 1,004 195% 186% 340

Asia Pacific ............................ 448 -2% -5% 455 217% 196% 143

Total revenues ...................... 2,475 -3% -4% 2,562 227% 218% 784

Expenses:

Hardware systems support(1) ............... 1,041 -17% -18% 1,254 198% 189% 421

Stock-based compensation ................ 5 1% 1% 5 124% 124% 2

Amortization of intangible assets(2) ......... 305 2% 2% 298 202% 202% 98

Total expenses ..................... 1,351 -13% -14% 1,557 199% 191% 521

Total Margin .......................... $ 1,124 12% 10% $ 1,005 283% 274% $ 263

Total Margin % ........................ 45% 39% 34%

% Revenues by Geography:

Americas .............................. 47% 43% 38%

EMEA ................................ 35% 39% 43%

Asia Pacific ............................ 18% 18% 19%

(1) Excluding stock-based compensation

(2) Included as a component of ‘Amortization of Intangible Assets’ in our consolidated statements of operations

62