Oracle 2012 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2012 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

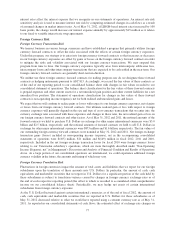

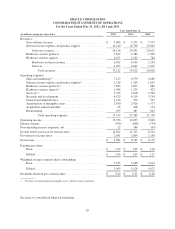

Stock Options and Restricted Stock-Based Awards

Our stock-based compensation program is a key component of the compensation package we provide to attract

and retain certain of our talented employees and align their interests with the interests of existing stockholders.

We historically have granted only stock options to our employees and any restricted stock-based awards

outstanding were assumed as a result of our acquisitions.

We recognize that options and restricted stock-based awards dilute existing stockholders and have sought to

control the number of options and restricted stock-based awards granted while providing competitive

compensation packages. Consistent with these dual goals, our cumulative potential dilution since June 1, 2009

has been a weighted average annualized rate of 1.7% per year. The potential dilution percentage is calculated as

the average annualized new options or restricted stock-based awards granted and assumed, net of options and

restricted stock-based awards forfeited by employees leaving the company, divided by the weighted average

outstanding shares during the calculation period. This maximum potential dilution will only result if all options

are exercised and restricted stock-based awards vest. Some of the outstanding options, which generally have a 10

year exercise period, have exercise prices higher than the current market price of our common stock. At May 31,

2012, 28.0% of our outstanding stock options had exercise prices in excess of the current market price. In recent

years, our stock repurchase program has more than offset the dilutive effect of our stock-based compensation

program; however, we may reduce the level of our stock repurchases in the future as we may use our available

cash for acquisitions, to pay dividends, to repay or repurchase indebtedness or for other purposes. At May 31,

2012, the maximum potential dilution from all outstanding and unexercised stock options and restricted stock-

based awards, regardless of when granted and regardless of whether vested or unvested and including options

where the strike price is higher than the current market price, was 8.7%.

The Compensation Committee of the Board of Directors reviews and approves the organization-wide stock

option grants to selected employees, all stock option grants to executive officers and any individual stock option

grants in excess of 100,000 shares. A separate Plan Committee, which is an executive officer committee,

approves individual stock option grants of up to 100,000 shares to non-executive officers and employees. Stock

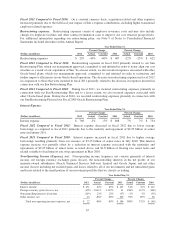

option and restricted stock-based award activity from June 1, 2009 through May 31, 2012 is summarized as

follows (shares in millions):

Options and restricted stock-based awards outstanding at May 31, 2009 ...............................

Options granted ........................................................................

Options and restricted stock-based awards assumed ...........................................

Options exercised and restricted stock-based awards vested .....................................

Forfeitures, cancellations and other, net .....................................................

359

294

43

(183)

(88)

Options and restricted stock-based awards outstanding at May 31, 2012 ............................... 425

Weighted average annualized options and restricted stock-based awards granted and assumed, net of

forfeitures and cancellations. ............................................................... 83

Weighted average annualized stock repurchases ..................................................

Shares outstanding at May 31, 2012 ............................................................

Basic weighted average shares outstanding from June 1, 2009 through May 31, 2012 .....................

Options and restricted stock-based awards outstanding as a percent of shares outstanding at May 31, 2012 ....

In the money options and total restricted stock-based awards outstanding (based on the closing price of our

common stock on the last trading day of our fiscal period presented) as a percent of shares outstanding at

May 31, 2012 ...........................................................................

Weighted average annualized options and restricted stock-based awards granted and assumed, net of

forfeitures and cancellations and before stock repurchases, as a percent of weighted average shares

outstanding from June 1, 2009 through May 31, 2012 ............................................

Weighted average annualized options and restricted stock-based awards granted and assumed, net of

forfeitures and cancellations and after stock repurchases, as a percent of weighted average shares

outstanding from June 1, 2009 through May 31, 2012 ............................................

(97)

4,905

5,026

8.7%

6.2%

1.7%

-0.3%

Our Compensation Committee approves the annual organization-wide option grants to certain employees. These

annual option grants are made during the ten business day period following the second trading day after the

announcement of our fiscal fourth quarter earnings report.

75