Oracle 2012 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2012 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2012

Recent Accounting Pronouncements

Presentation of Comprehensive Income: In June 2011, the FASB issued Accounting Standards Update

No. 2011-05, Comprehensive Income (Topic 220)—Presentation of Comprehensive Income (ASU 2011-05), to

require an entity to present the total of comprehensive income, the components of net income and the

components of other comprehensive income either in a single continuous statement of comprehensive income or

in two separate but consecutive statements. ASU 2011-05 eliminates the option to present the components of

other comprehensive income as part of the statement of equity. In December 2011, the FASB issued Accounting

Standards Update No. 2011-12, Comprehensive Income (Topic 220)—Deferral of the Effective Date for

Amendments to the Presentation of Reclassifications of Items Out of Accumulated Other Comprehensive Income

in Accounting Standards Update No. 2011-05 (ASU 2011-12), which defers the requirement to present

reclassification adjustments for each component of other comprehensive income on the face of the financial

statements. ASU 2011-05 and ASU 2011-12 are effective for us in our first quarter of fiscal 2013 and should be

applied retrospectively. We are currently evaluating the impact of our pending adoption of ASU 2011-05 and

ASU 2011-12 on our consolidated financial statements.

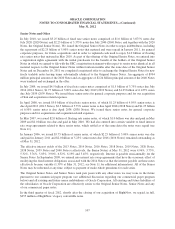

2. ACQUISITIONS

Fiscal 2012 Acquisitions

Acquisition of Taleo Corporation

On April 5, 2012, we completed our acquisition of Taleo Corporation (Taleo), a provider of cloud-based talent

management solutions. We have included the financial results of Taleo in our consolidated financial statements

from the date of acquisition. These results were not individually material to our consolidated financial

statements. The total preliminary purchase price for Taleo was approximately $2.0 billion, which consisted of

approximately $2.0 billion in cash and $10 million for the fair value of stock options and restricted stock-based

awards assumed. We have preliminarily recorded $1.1 billion of identifiable intangible assets and $282 million

of net tangible liabilities related primarily to deferred tax liabilities and customer performance obligations that

were assumed as a part of this acquisition based on their estimated fair values and $1.2 billion of residual

goodwill.

Acquisition of RightNow Technologies, Inc.

On January 25, 2012, we completed our acquisition of RightNow Technologies, Inc. (RightNow), a provider of

cloud-based customer service. We have included the financial results of RightNow in our consolidated financial

statements from the date of acquisition. These results were not individually material to our consolidated financial

statements. The total preliminary purchase price for RightNow was approximately $1.5 billion, which consisted

of approximately $1.5 billion in cash and $14 million for the fair value of stock options and restricted stock-

based awards assumed. We have preliminarily recorded $697 million of identifiable intangible assets and $296

million of net tangible liabilities related primarily to customer performance obligations, convertible debt and

deferred tax liabilities that were assumed as a part of this acquisition based on their estimated fair values, and

$1.1 billion of residual goodwill.

Acquisition of Pillar Data Systems, Inc.

On July 18, 2011, we acquired Pillar Data Systems, Inc. (Pillar Data), a provider of enterprise storage systems

solutions. Prior to the acquisition, Pillar Data was directly and indirectly majority-owned and controlled by

Lawrence J. Ellison, our Chief Executive Officer, director and largest stockholder. Pursuant to the agreement and

plan of merger dated as of June 29, 2011 (Merger Agreement), we acquired all of the issued and outstanding

equity interests of Pillar Data from the stockholders in exchange for rights to receive contingent cash

consideration (Earn-Out), if any, pursuant to an Earn-Out calculation. An affiliate of Mr. Ellison’s has a

99