Oracle 2012 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2012 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2012

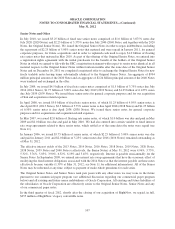

preference right to receive the first approximately $565 million of the Earn-Out, if any, and rights to 55% of any

amount of the Earn-Out that exceeds $565 million.

The Earn-Out will be calculated with respect to a three-year period that commenced with our second quarter of

fiscal 2012 and will conclude with our first quarter of fiscal 2015 (Earn-Out Period). The Earn-Out will be an

amount (if positive) calculated based on the product of (i) the difference between (x) future revenues generated

from the sale of certain Pillar Data products during Oracle’s last four full fiscal quarters during the Earn-Out

Period minus (y) certain losses associated with certain Pillar Data products incurred over the entire Earn-Out

Period, multiplied by (ii) three. Our obligation to pay the Earn-Out will be subject to reduction as a result of our

right to set-off the amount of any indemnification claims we may have under the Merger Agreement. We do not

expect the amount of the Earn-Out or its potential impact will be material to our results of operations or financial

position.

We have included the financial results of Pillar Data in our consolidated financial statements from the date of

acquisition. These results were not material to our consolidated financial statements. The estimated fair value of

the liability for contingent consideration, representing the preliminary purchase price payable for our acquisition

of Pillar Data, was approximately $346 million and was included in other non-current liabilities in our

consolidated balance sheet. This preliminary purchase price payable may differ from the amount that is

ultimately payable via the Earn-Out calculation (described above) with any changes in the liability recorded as

acquisition related and other in our consolidated statements of operations until the liability is settled. We have

preliminarily recorded $142 million of identifiable intangible assets and $11 million of net tangible liabilities,

based on their estimated fair values, and $215 million of residual goodwill. The fair value of contingent

consideration payable was estimated using a discounted cash flow technique with significant inputs that are not

observable in the market and thus represents a Level 3 fair value measurement as defined in the ASC 820. The

significant inputs in the Level 3 measurement not supported by market activity included our probability

assessments of expected future cash flows related to our acquisition of Pillar Data during the Earn-Out Period,

appropriately discounted considering the uncertainties associated with the obligation, and calculated in

accordance with the terms of the Merger Agreement. Subsequent to the date of acquisition, the estimated fair

value of the Earn-Out liability increased to $387 million as of May 31, 2012 primarily as a result of the passage

of time and the corresponding impact of discounting.

Other Fiscal 2012 Acquisitions

During fiscal 2012, we acquired certain other companies and purchased certain technology and development

assets primarily to expand our products and services offerings. These acquisitions were not individually

significant. We have included the financial results of these companies in our consolidated financial statements

from their respective acquisition dates and the results from each of these companies were not individually

material to our consolidated financial statements. In the aggregate, the total preliminary purchase price for these

acquisitions was approximately $1.6 billion, which consisted of approximately $1.6 billion in cash and $5 million

for the fair value of stock options assumed. We have preliminarily recorded $540 million of identifiable

intangible assets and $29 million of net tangible liabilities related primarily to deferred tax liabilities, based on

their estimated fair values, and $1.1 billion of residual goodwill.

In aggregate, companies acquired during fiscal 2012 collectively contributed $231 million to our total software

revenues during fiscal 2012. Other collective revenue and earnings contributions were not significant or were not

separately identifiable due to the integration of these acquired entities into our existing operations.

The preliminary fair value estimates for the assets acquired and liabilities assumed for all acquisitions completed

during fiscal 2012 were based upon preliminary calculations and valuations and our estimates and assumptions

for each of these acquisitions are subject to change as we obtain additional information for our estimates during

the respective measurement periods (up to one year from the respective acquisition dates). The primary areas of

100