Oracle 2012 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2012 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

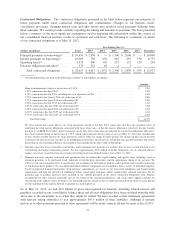

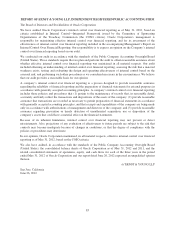

Contractual Obligations: The contractual obligations presented in the table below represent our estimates of

future payments under fixed contractual obligations and commitments. Changes in our business needs,

cancellation provisions, changing interest rates and other factors may result in actual payments differing from

these estimates. We cannot provide certainty regarding the timing and amounts of payments. We have presented

below a summary of the most significant assumptions used in preparing this information within the context of

our consolidated financial position, results of operations and cash flows. The following is a summary of certain

of our contractual obligations as of May 31, 2012:

Year Ending May 31,

(Dollars in millions) Total 2013 2014 2015 2016 2017 Thereafter

Principal payments on borrowings(1) .... $ 16,450 $ 2,950 $ — $ 1,500 $ 2,000 $ — $ 10,000

Interest payments on borrowings(1) ..... 10,063 738 676 665 655 550 6,779

Operating leases(2) .................. 1,535 406 307 227 172 129 294

Purchase obligations and other(3) ....... 579 523 49 4 3 — —

Total contractual obligations ...... $ 28,627 $ 4,617 $ 1,032 $ 2,396 $ 2,830 $ 679 $ 17,073

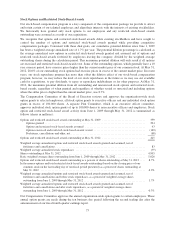

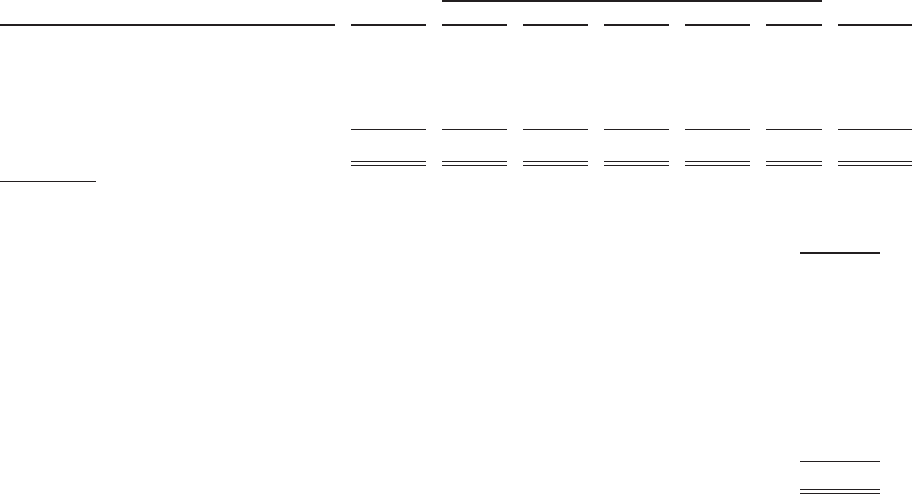

(1) Our total borrowings consisted of the following as of May 31, 2012 (dollars in millions):

Amount

Short-term borrowings (effective interest rate of 0.24%) ............................................... $ 1,700

4.95% senior notes due April 2013 ................................................................ 1,250

3.75% senior notes due July 2014, including fair value adjustment of $69 ................................. 1,569

5.25% senior notes due January 2016, net of discount of $4 ............................................ 1,996

5.75% senior notes due April 2018, net of discount of $1 .............................................. 2,499

5.00% senior notes due July 2019, net of discount of $5 ............................................... 1,745

3.875% senior notes due July 2020, net of discount of $2 .............................................. 998

6.50% senior notes due April 2038, net of discount of $2 .............................................. 1,248

6.125% senior notes due July 2039, net of discount of $8 .............................................. 1,242

5.375% senior notes due July 2040, net of discount of $24 ............................................. 2,226

Total borrowings .......................................................................... $ 16,473

We have entered into certain interest rate swap agreements related to our July 2014 senior notes that have the economic effect of

modifying the fixed interest obligations associated with these senior notes so that the interest obligations effectively became variable

pursuant to a LIBOR-based index. Interest payments on the July 2014 senior notes presented in the contractual obligations table above

have been estimated using an interest rate of 1.39%, which represented our effective interest rate as of May 31, 2012 after consideration

of these fixed to variable interest rate swap agreements, and are subject to change in future periods. The changes in fair value of our debt

associated with the interest rate risk that we are hedging pursuant to these agreements are included in notes payable and other non-current

borrowings in our consolidated balance sheet and have been included in the above table of borrowings.

(2) Primarily represents leases of facilities and includes future minimum rent payments for facilities that we have vacated pursuant to our

restructuring and merger integration activities. We have approximately $249 million in facility obligations, net of estimated sublease

income, for certain vacated locations in accrued restructuring in our consolidated balance sheet at May 31, 2012.

(3) Primarily represents amounts associated with agreements that are enforceable, legally binding and specify terms, including: fixed or

minimum quantities to be purchased; fixed, minimum or variable price provisions; and the approximate timing of the payment. We

utilize several external manufacturers to manufacture sub-assemblies for our hardware products and to perform final assembly and testing

of finished hardware products. We also obtain individual hardware components for our products from a variety of individual suppliers

based on projected demand information. Such purchase commitments are based on our forecasted component and manufacturing

requirements and typically provide for fulfillment within agreed upon lead-times and/or commercially standard lead-times for the

particular part or product and have been included in the amount presented in the above contractual obligations table. Routine

arrangements for other materials and goods that are not related to our external manufacturers and certain other suppliers and that are

entered into in the ordinary course of business are not included in this amount as they are generally entered into in order to secure pricing

or other negotiated terms and are difficult to quantify in a meaningful way.

As of May 31, 2012, we had $4.0 billion of gross unrecognized tax benefits, including related interest and

penalties, recorded on our consolidated balance sheet and all such obligations have been excluded from the table

above due to the uncertainty as to when they might be settled. We have reached certain settlement agreements

with relevant taxing authorities to pay approximately $47.5 million of these liabilities. Although it remains

unclear as to when payments pursuant to these agreements will be made, some or all may be made in fiscal 2013.

73