Oracle 2012 Annual Report Download - page 63

Download and view the complete annual report

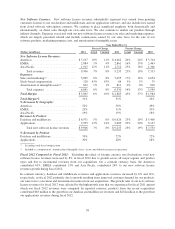

Please find page 63 of the 2012 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.As a result of our acquisitions, we recorded adjustments to reduce assumed cloud software subscription

obligations to their estimated fair values at the acquisition dates. Due to our application of business combination

accounting rules, cloud software subscription revenues in the amount of $22 million that would have been

otherwise recorded by our acquired businesses as independent entities were not recognized in fiscal 2012. To the

extent underlying cloud software subscription contracts are renewed with us following an acquisition, we will

recognize the revenues for the full value of the cloud software subscription contracts over the contract periods.

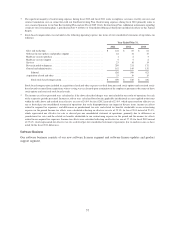

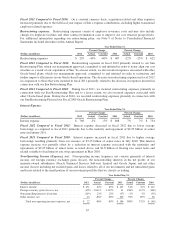

In reported currency, new software license revenues earned from transactions of $3 million or greater increased by 4% in

fiscal 2012 and represented 27% of our new software license revenues in fiscal 2012 in comparison to 28% in fiscal 2011.

Excluding the effect of currency rate fluctuations, our total new software license expenses increased in fiscal

2012 primarily due to higher employee related expenses from increased headcount.

Excluding the effect of unfavorable foreign currency rate fluctuations, new software license margin increased

due to the increase in revenues, and new software license margin as a percentage of revenues was flat as our

revenues increased at the same rate as our operating expenses.

Fiscal 2011 Compared to Fiscal 2010: Excluding the effect of favorable foreign currency rate fluctuations,

total new software license revenues increased by 19% in fiscal 2011 due to growth across all major regions and

product types and incremental revenues from our acquisitions. On a constant currency basis, the Americas

contributed 63%, EMEA contributed 21% and Asia Pacific contributed 16% to our new software license

revenues growth during fiscal 2011.

In constant currency, database and middleware revenues and applications revenues increased by 19% and 20%,

respectively, in fiscal 2011 primarily due to similar reasons as those noted above. In reported currency, Sun

contributed $398 million in growth to our database and middleware revenues through the third quarter of fiscal

2011 (the one year anniversary of our acquisition of Sun) and our other recent acquisitions contributed $40

million during fiscal 2011. In reported currency, our recent acquisitions contributed $191 million to the growth in

our applications revenues during fiscal 2011.

In reported currency, new software license revenues earned from transactions of $3 million or greater increased by 47% in

fiscal 2011 and represented 28% of our new software license revenues in fiscal 2011 in comparison to 23% in fiscal 2010.

Excluding the effect of unfavorable foreign currency rate fluctuations, total software sales and marketing

expenses increased in fiscal 2011 primarily due to higher employee related and other operating expenses

resulting from a full year of expense contributions from Sun to our fiscal 2011 operating results and higher

variable compensation expenses resulting from higher revenues.

Excluding the effect of favorable foreign currency rate fluctuations, new software license margin and margin as a

percentage of revenues increased as our revenues increased at a faster rate than our expenses.

59