Oracle 2012 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2012 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2012

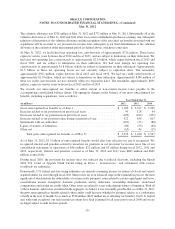

Internationally, tax authorities for numerous non-U.S. jurisdictions are also examining returns affecting our

unrecognized tax benefits. We believe it was reasonably possible that, as of May 31, 2012, the gross

unrecognized tax benefits, could decrease (whether by payment, release, or a combination of both) by as much as

$189 million ($123 million net of offsetting tax benefits) in the next 12 months, related primarily to transfer

pricing. Other issues are related to years with expiring statutes of limitation. With some exceptions, we are

generally no longer subject to tax examinations in non-U.S. jurisdictions for years prior to fiscal 1998.

We believe that we have adequately provided for any reasonably foreseeable outcomes related to our tax audits

and that any settlement will not have a material adverse effect on our consolidated financial position or results of

operations. However, there can be no assurances as to the possible outcomes.

We previously negotiated three successive unilateral Advance Pricing Agreements with the IRS that cover many

of our intercompany transfer pricing issues and preclude the IRS from making a transfer pricing adjustment

within the scope of these agreements. These agreements were effective for fiscal years through May 31, 2006.

We have reached final agreement with the IRS for renewal of this Advance Pricing Agreement for the years

ending May 31, 2007 through May 31, 2013. However, these agreements do not cover substantial elements of our

transfer pricing and do not bind tax authorities outside the United States. We have finalized bilateral Advance

Pricing Agreements, which are effective for the years ending May 31, 2002 through May 31, 2006 and May 31,

2007 through May 31, 2013.

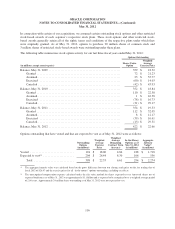

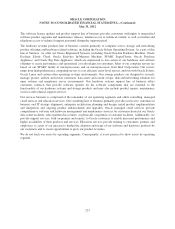

16. SEGMENT INFORMATION

ASC 280, Segment Reporting, establishes standards for reporting information about operating segments. Operating

segments are defined as components of an enterprise about which separate financial information is available that is

evaluated regularly by the chief operating decision maker, or decision making group, in deciding how to allocate

resources and in assessing performance. Our chief operating decision maker is our Chief Executive Officer. We are

organized geographically and by line of business. While our Chief Executive Officer evaluates results in a number

of different ways, the line of business management structure is the primary basis for which the allocation of

resources and financial results are assessed. We have three businesses—software, hardware systems and services—

which are further divided into certain operating segments. Our software business is comprised of two operating

segments: (1) new software licenses and (2) software license updates and product support. Our hardware systems

business is comprised of two operating segments: (1) hardware systems products and (2) hardware systems support.

All other operating segments are combined under our services business.

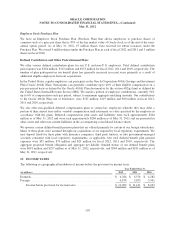

The new software licenses line of business is engaged in the licensing of our database and middleware software

and our applications software and our cloud software subscription offerings. Database and middleware software

generally includes database and database management software; application server and cloud application

software; Service-Oriented Architecture and business process management software; business intelligence

software; identity and access management software; data integration software; web experience management,

portals, content management and social network software; and development tools. Our database and middleware

software product offerings also include Java, which is a global software development platform used in a wide

range of computers, networks and devices. Applications software generally provides enterprise information that

enables companies to manage their business cycles and provides intelligence and includes enterprise resource

planning software including human capital management; customer relationship management; financials;

governance, risk and compliance; procurement; supply chain management; enterprise portfolio project

management; enterprise performance management; business intelligence analytic applications; web commerce

and industry-specific applications. Our cloud software subscription offerings include Oracle Cloud, which is a

family of our cloud-based software subscription offerings that provides our customers and partners subscription-

based, self-service access to certain of our database and middleware, and applications software. Our cloud

software subscription offerings also include Oracle RightNow Customer Experience and Oracle Taleo Talent

Management Cloud Service, among others.

122